Am 3. Februar 2026 wurden 151 Trading-Signale für den US-Aktienmarkt generiert. Mit 85 bullishen und 66 bearishen Signalen zeigt sich eine optimistische Marktstimmung. Die stärkste Strategie heute: 52W High Breakout.

151

Signale

85

Bullish

66

Bearish

56

Ø Score

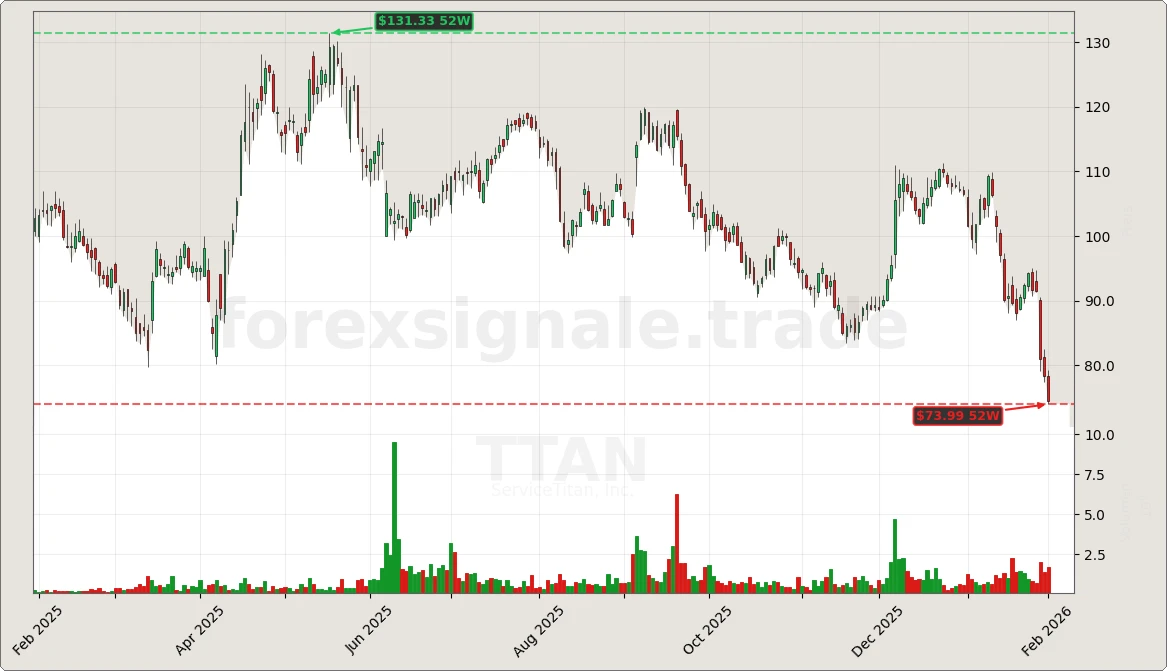

TTAN

Bearish

92%

Bearish

92%

EOG

Bearish

92%

Bearish

92%

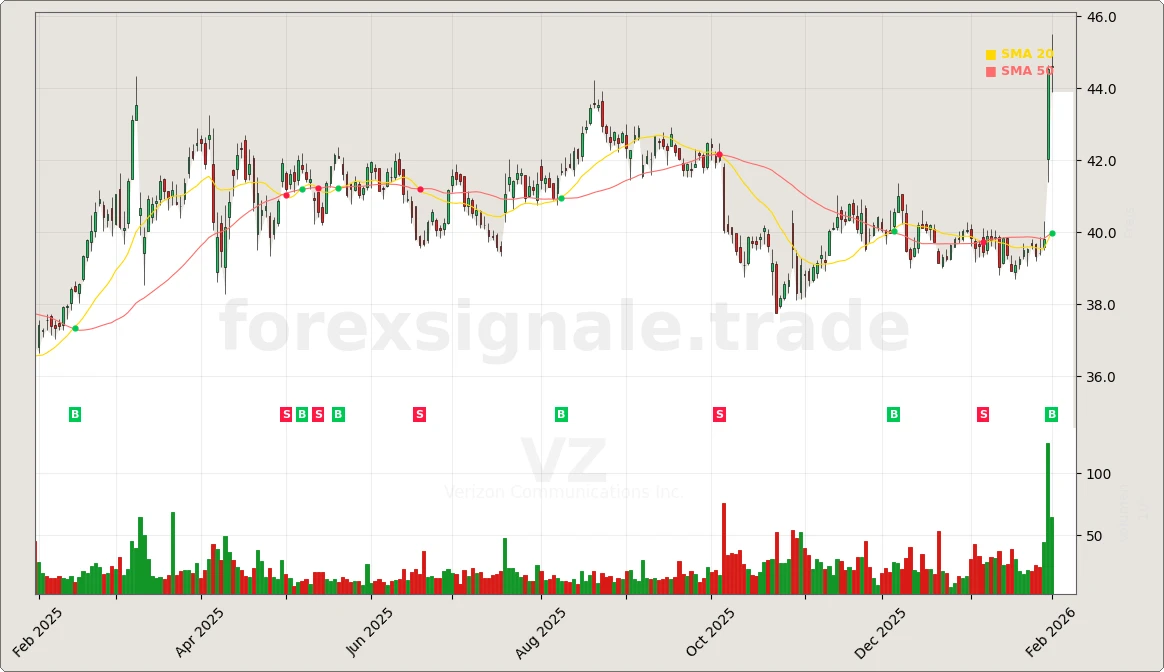

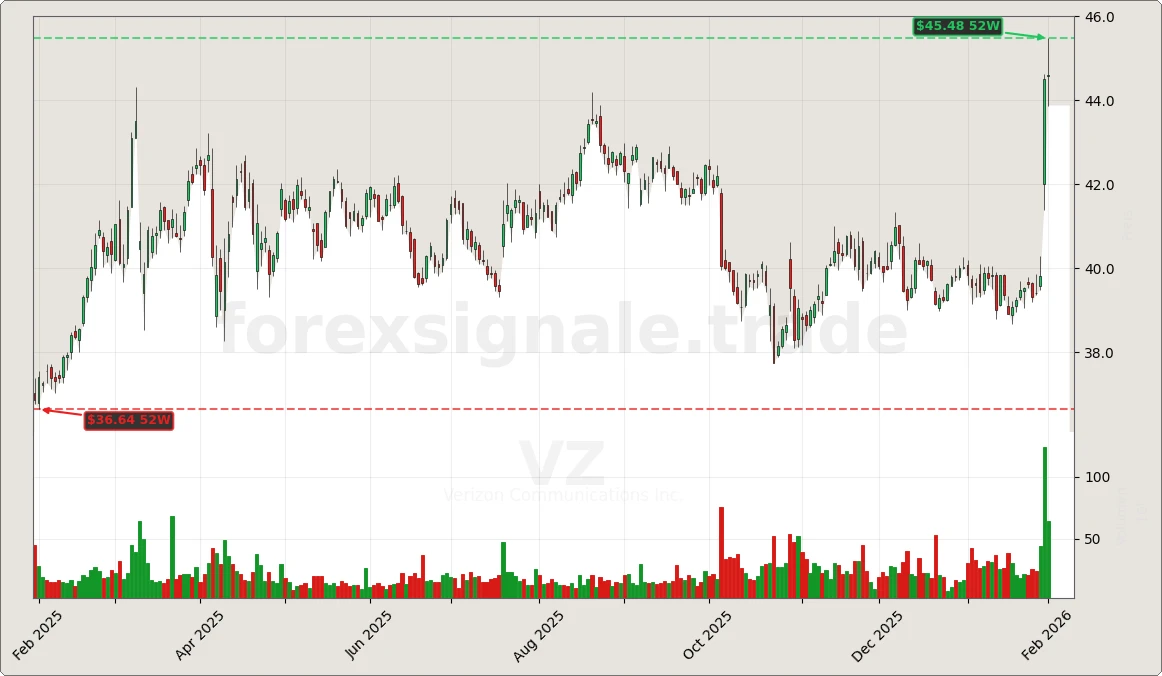

VZ

Bullish

85%

Bullish

85%

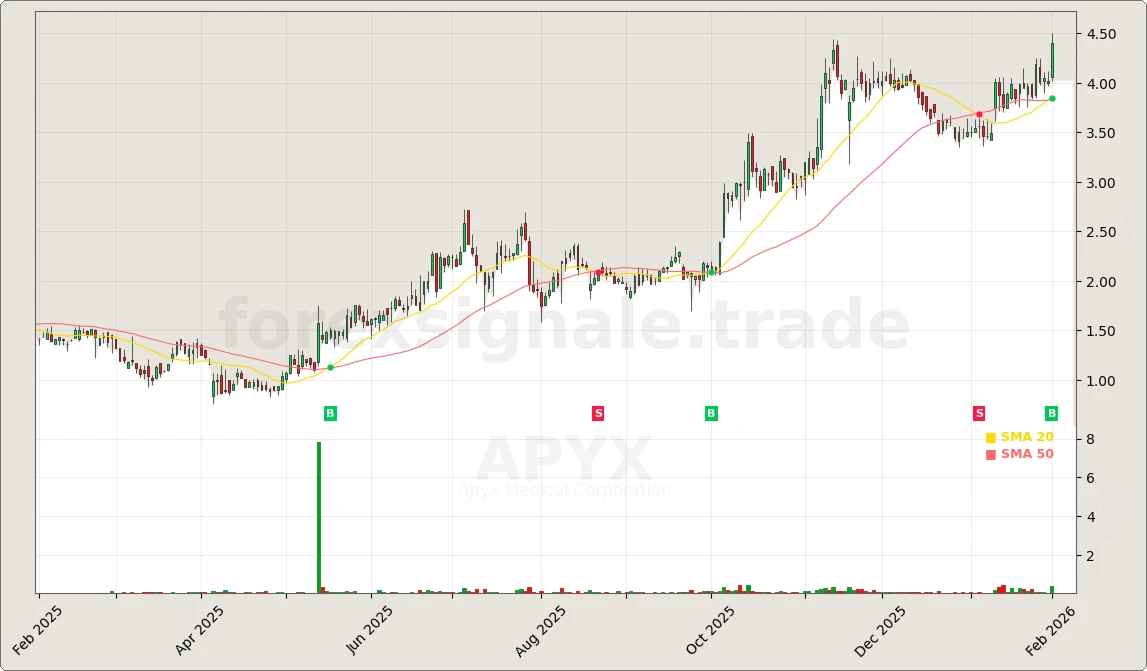

APYX

Bullish

85%

Bullish

85%

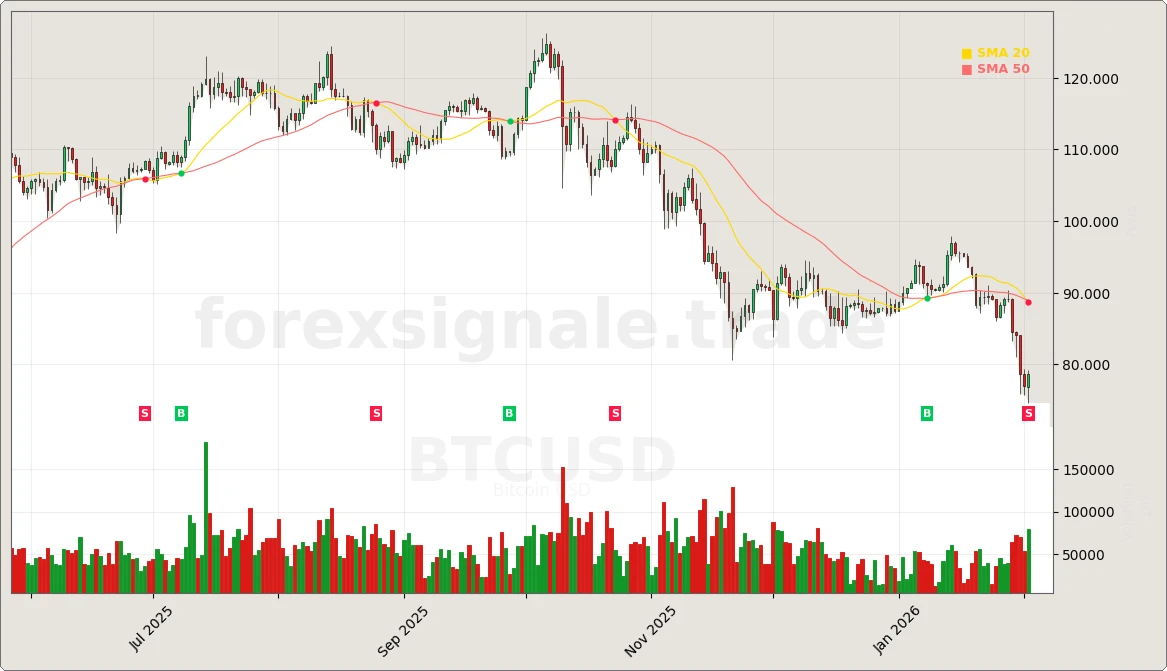

BTCUSD

Bearish

85%

Bearish

85%

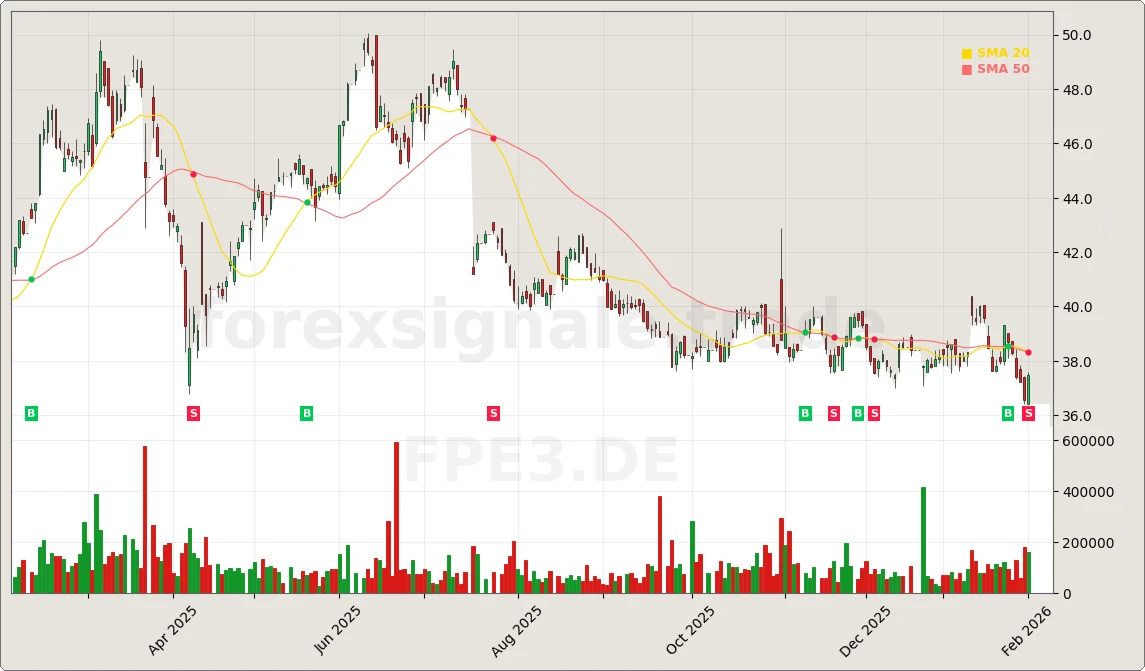

FPE3.DE

Bearish

85%

Bearish

85%

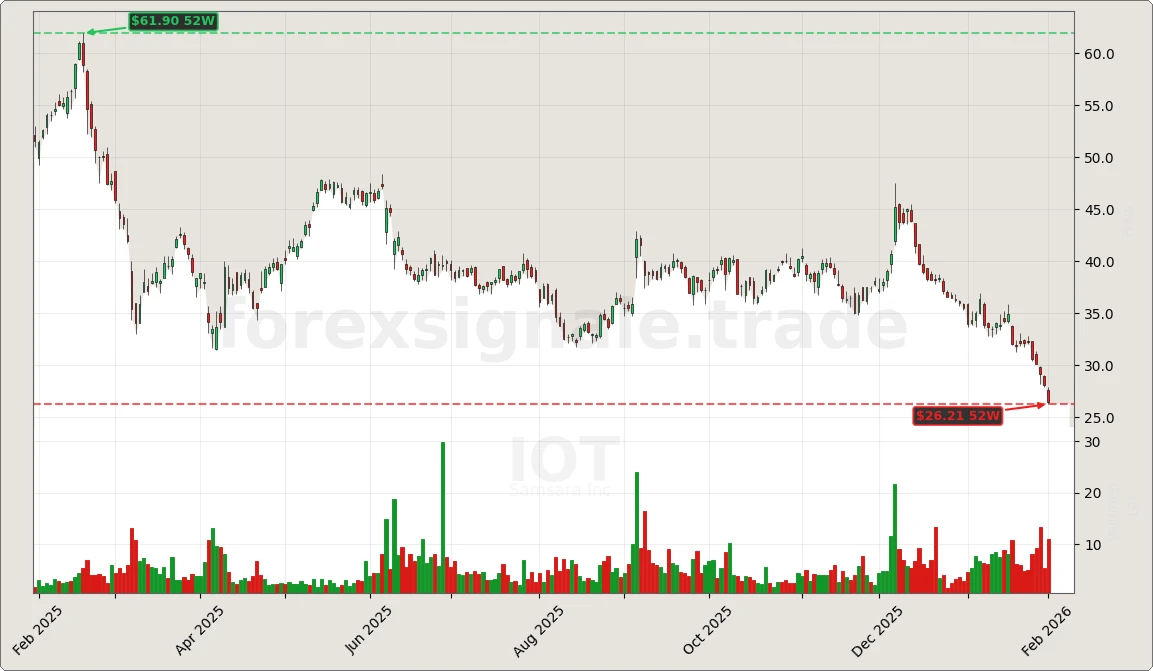

IOT

Bearish

85%

Bearish

85%

EBC

Bullish

82%

Bullish

82%

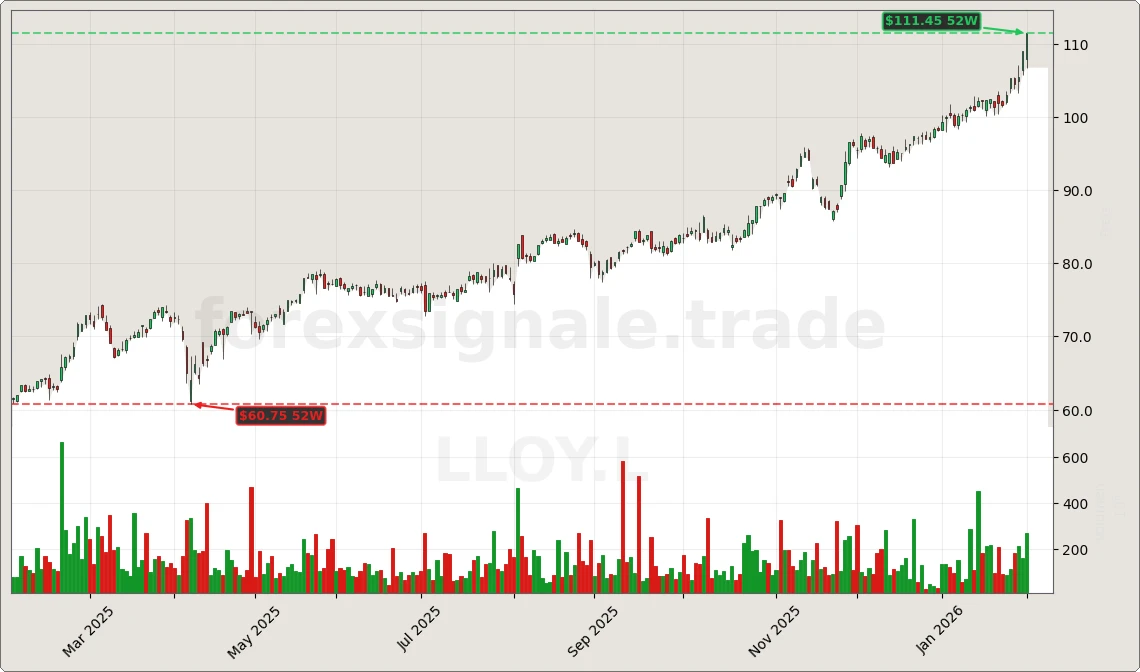

LLOY.L

Bullish

82%

Bullish

82%

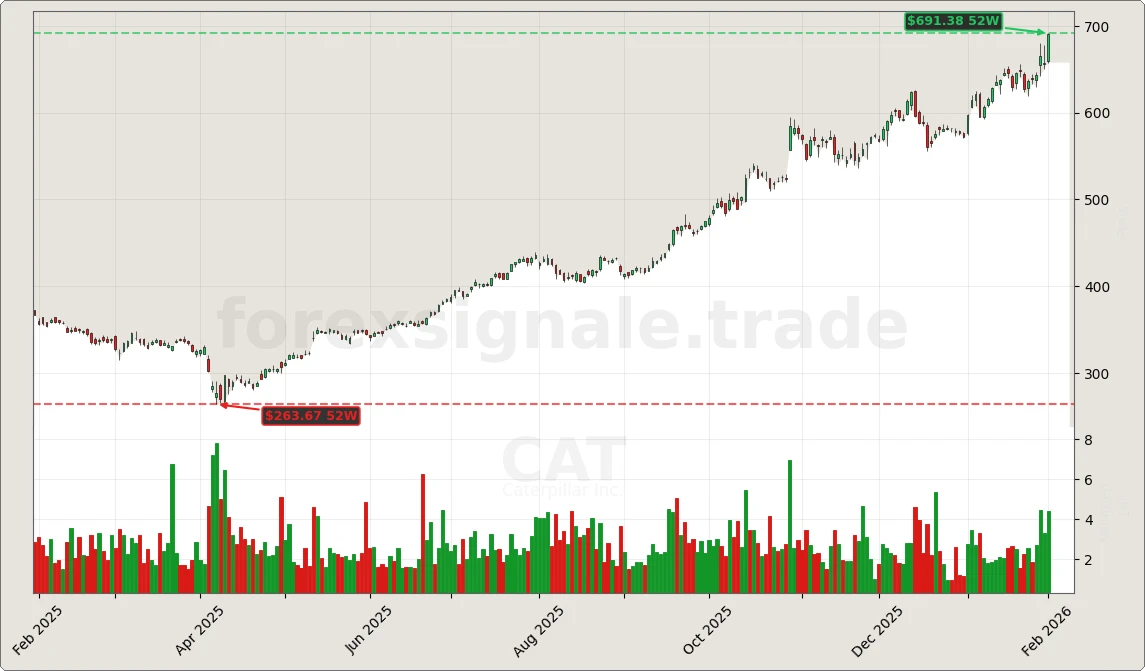

CAT

Bullish

82%

Bullish

82%

ARL

Bullish

80%

Bullish

80%

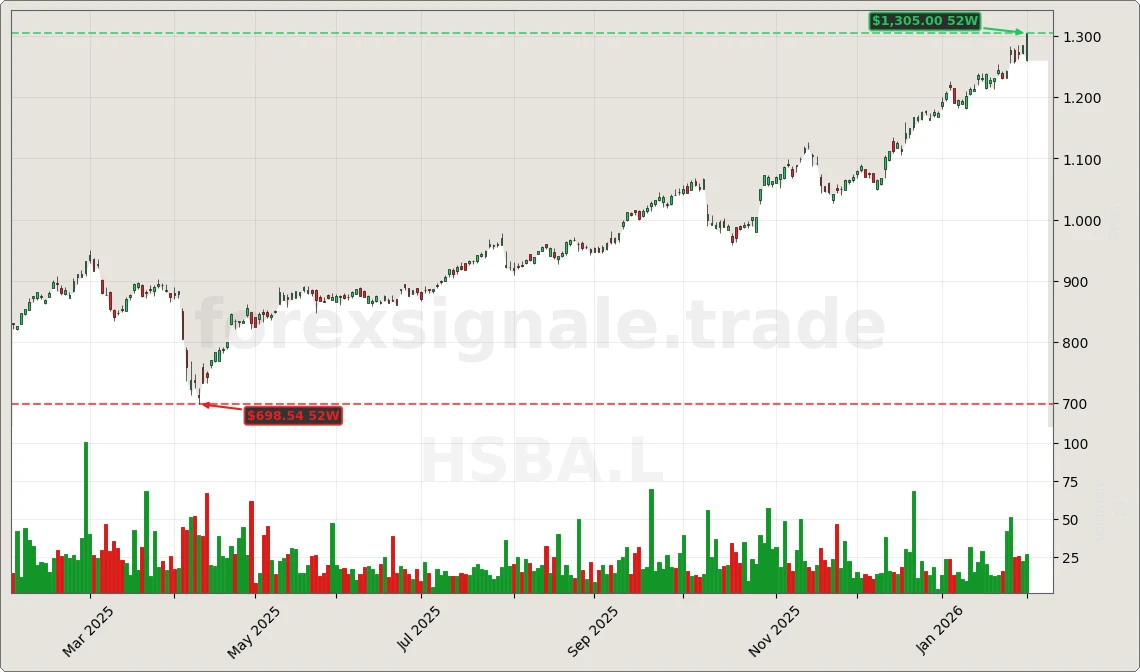

HSBA.L

Bullish

75%

Bullish

75%

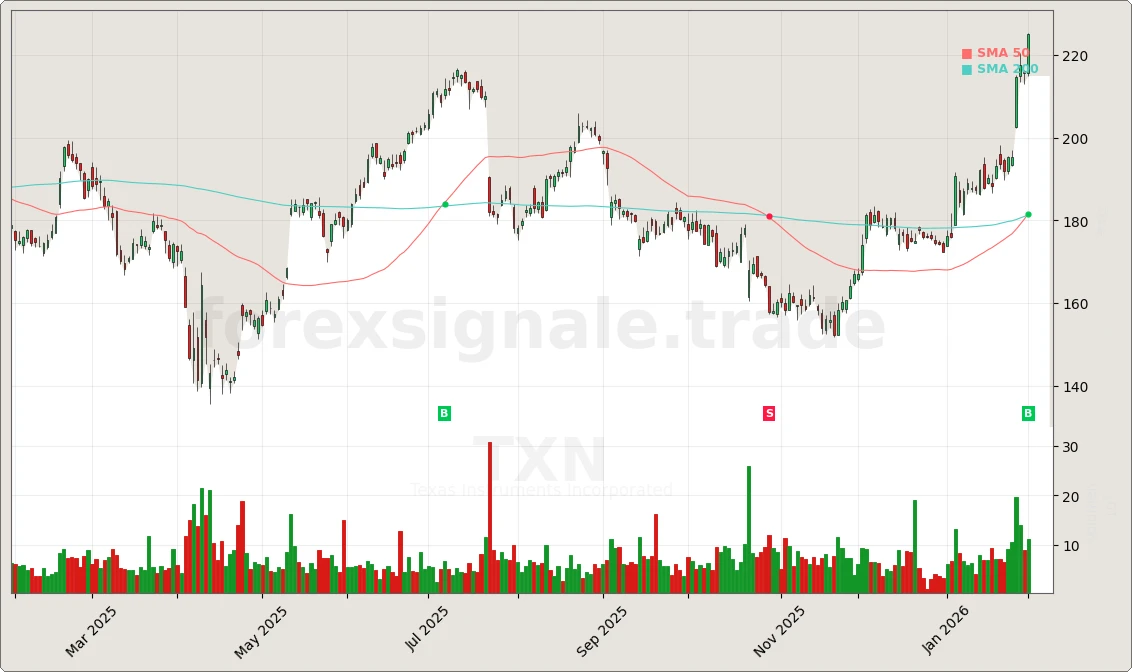

TXN

Bullish

75%

Bullish

75%

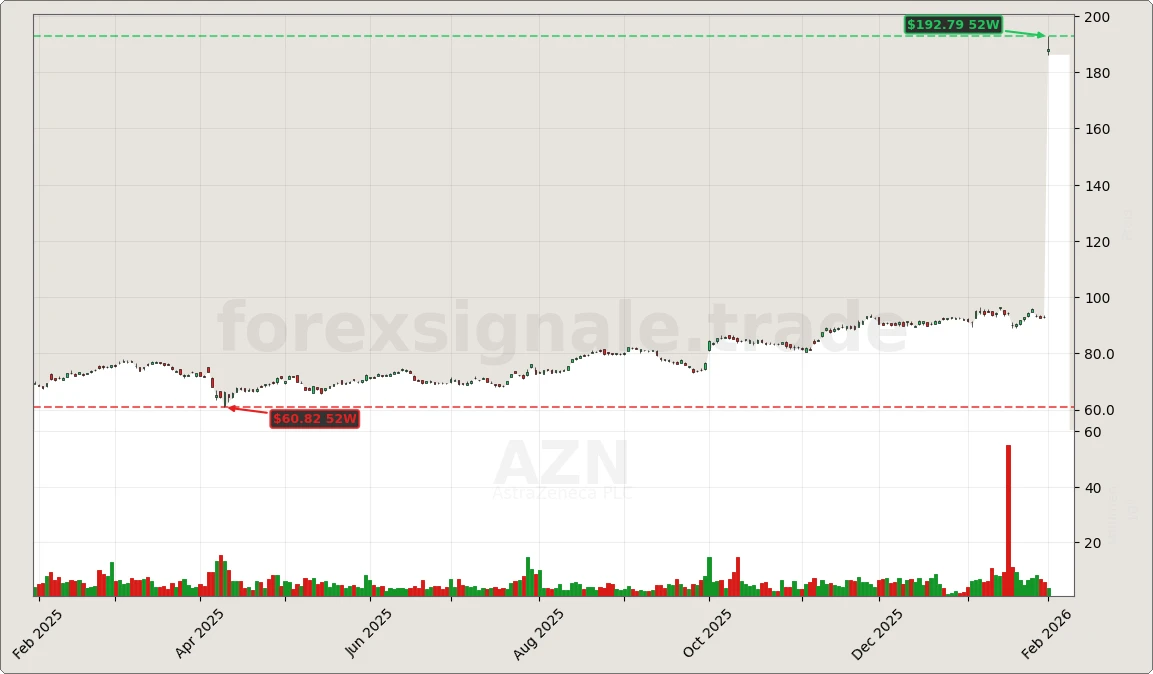

AZN

Bullish

75%

Bullish

75%

FDX

Bullish

75%

Bullish

75%

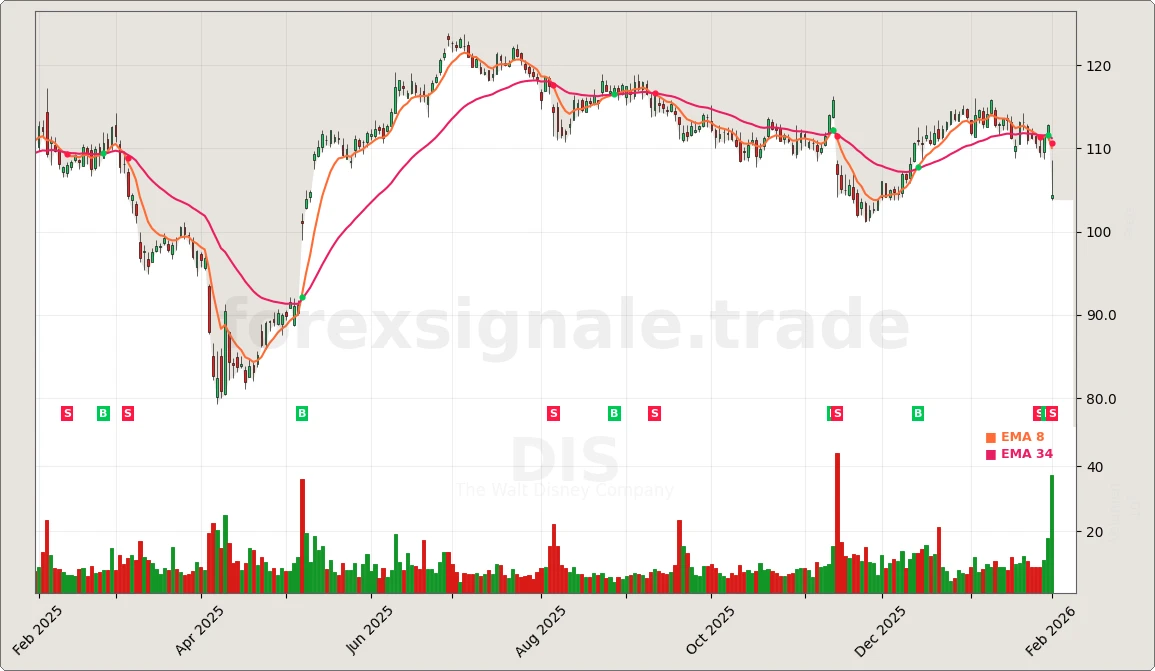

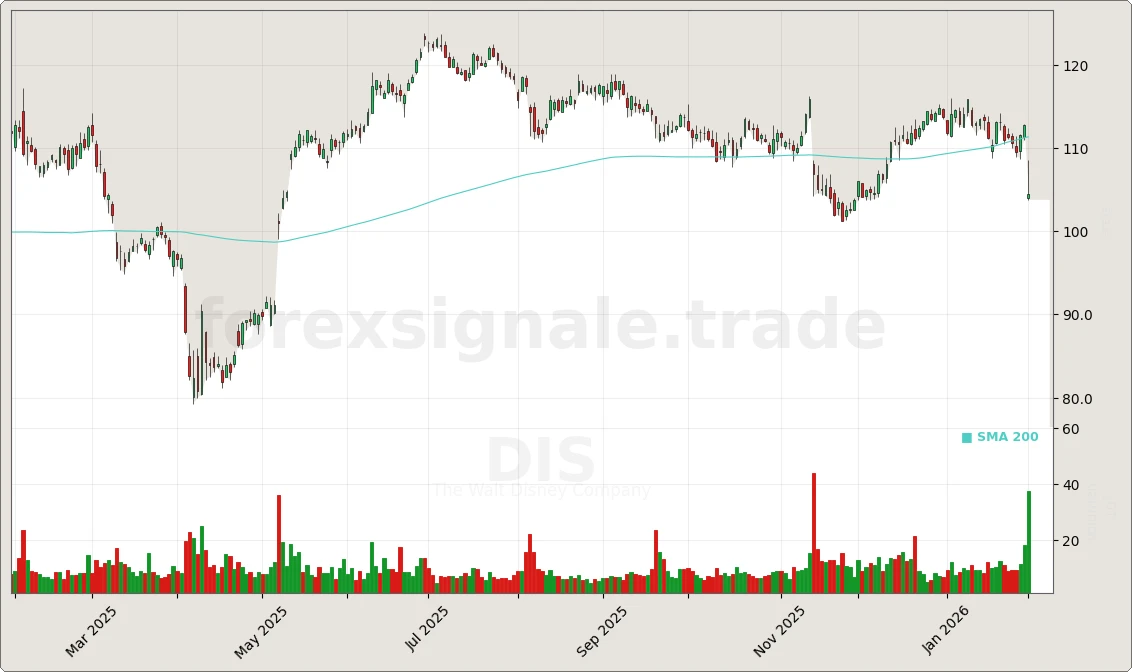

DIS

Bearish

75%

Bearish

75%

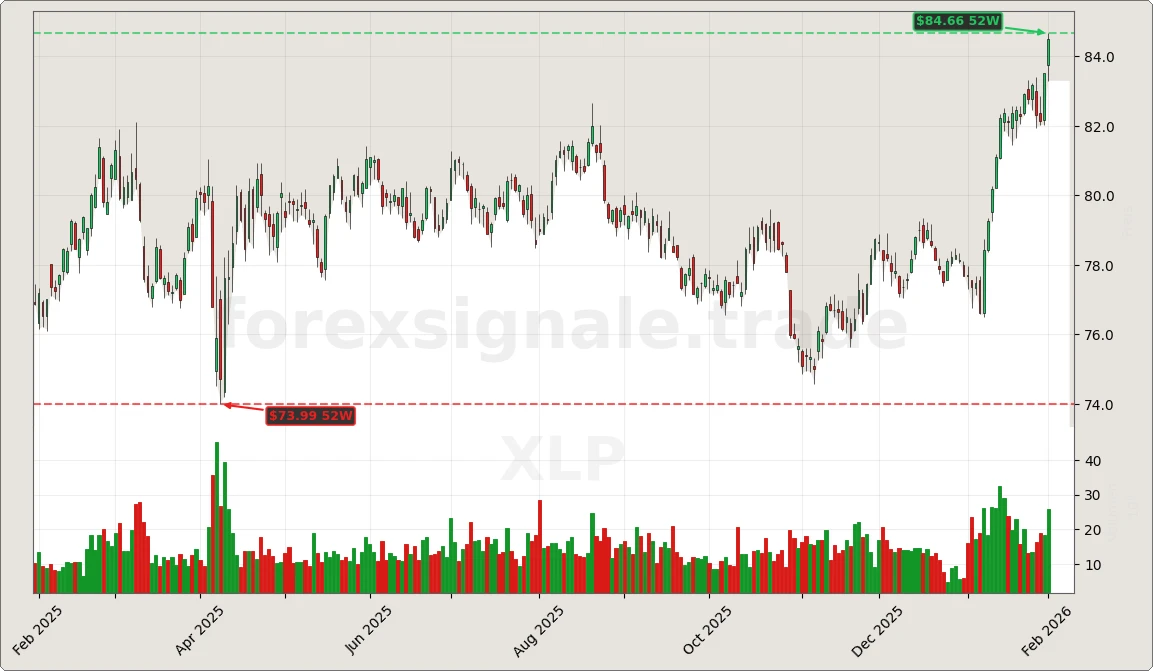

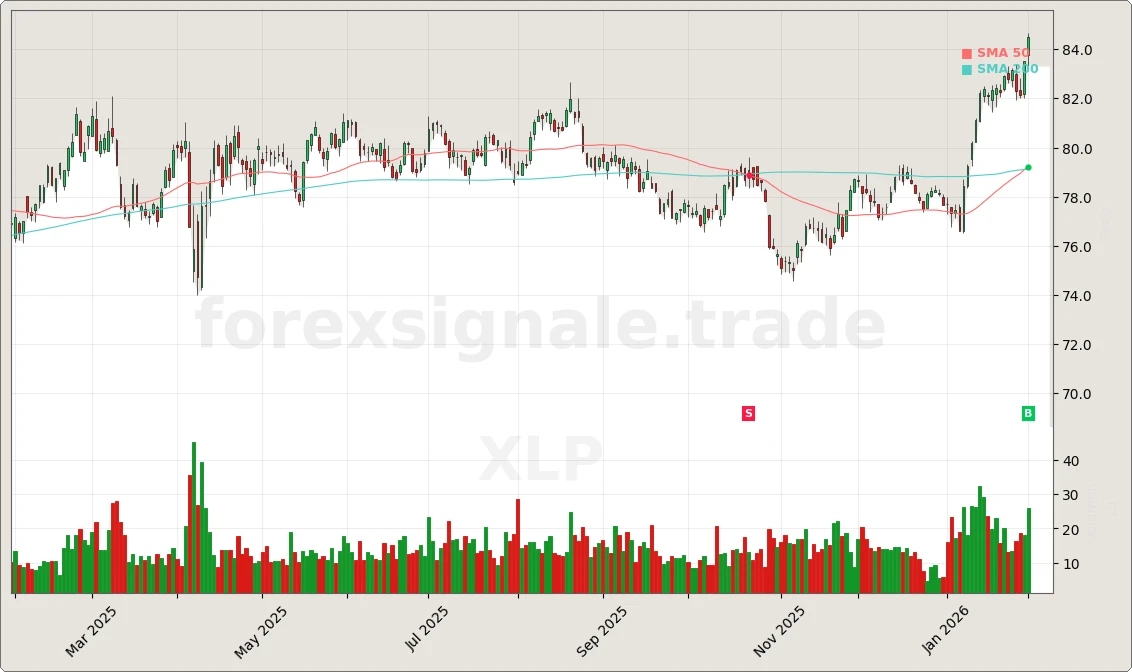

XLP

Bullish

75%

Bullish

75%

VIK

Bullish

75%

Bullish

75%

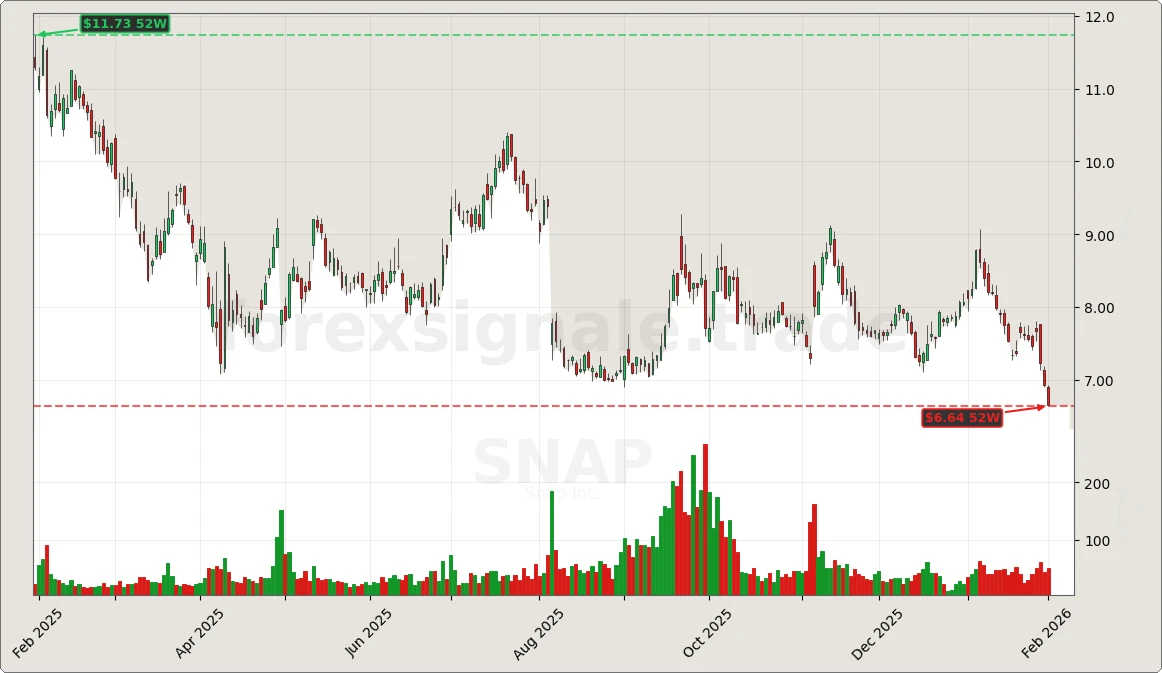

SNAP

Bearish

75%

Bearish

75%

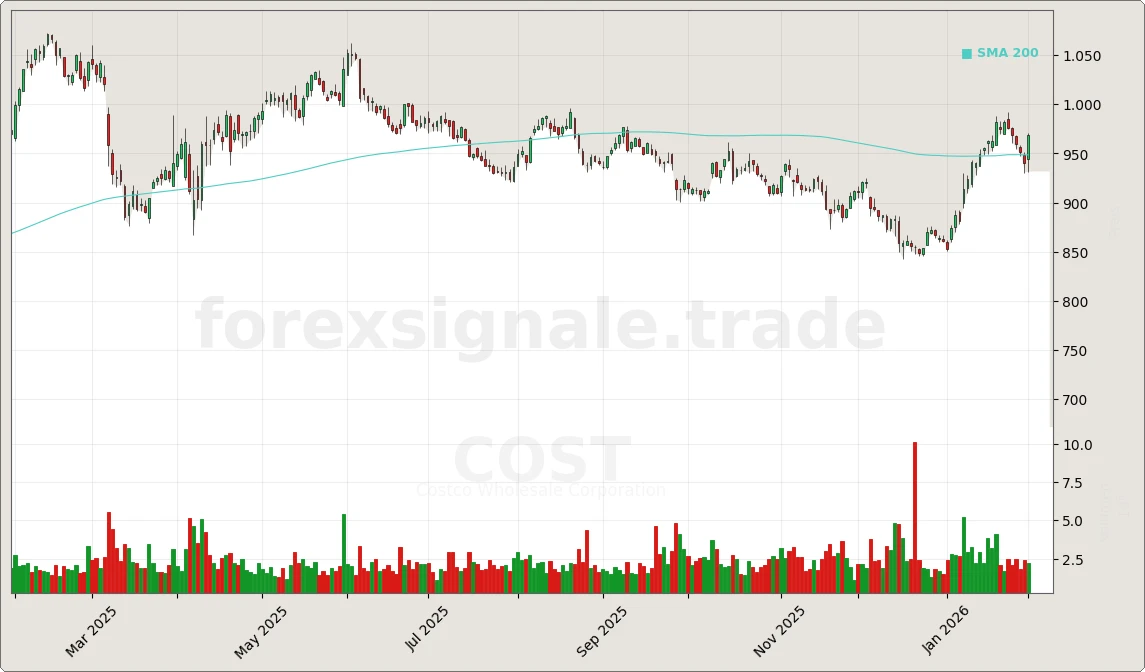

COST

Bullish

75%

Bullish

75%

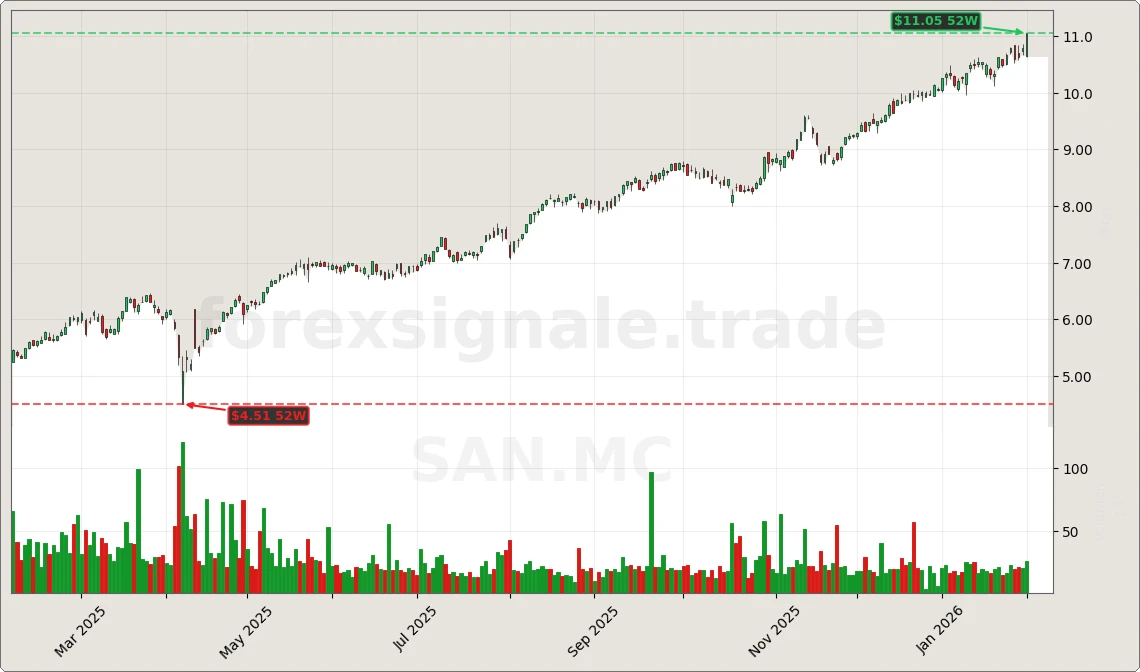

SAN.MC

Bullish

75%

Bullish

75%

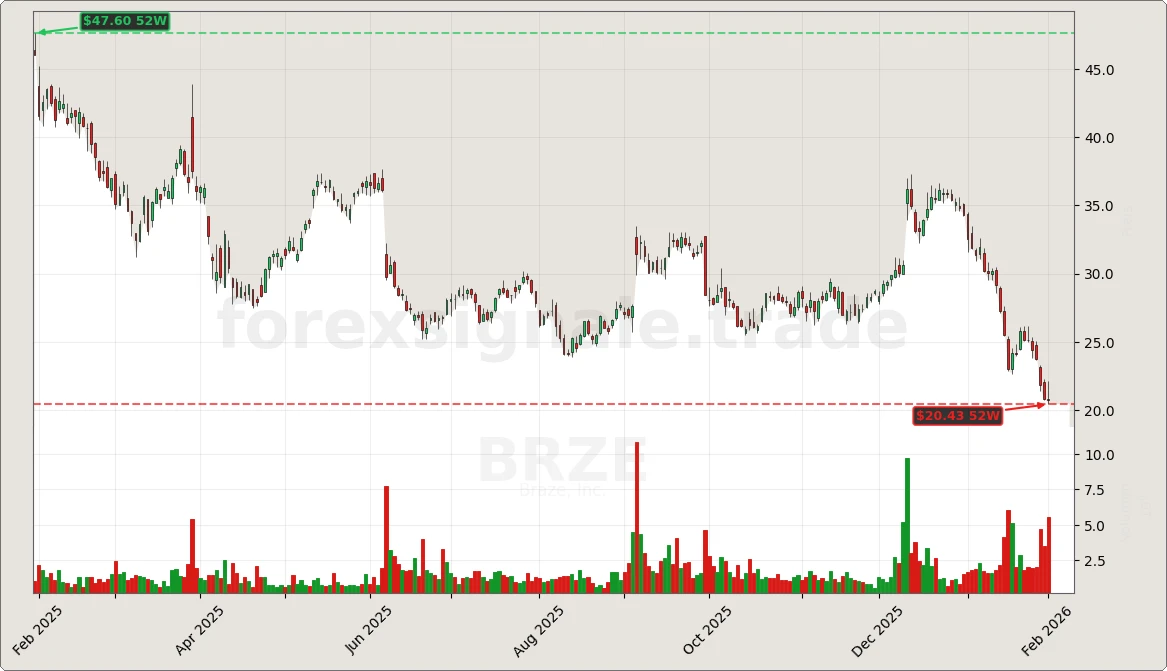

BRZE

Bearish

72%

Bearish

72%

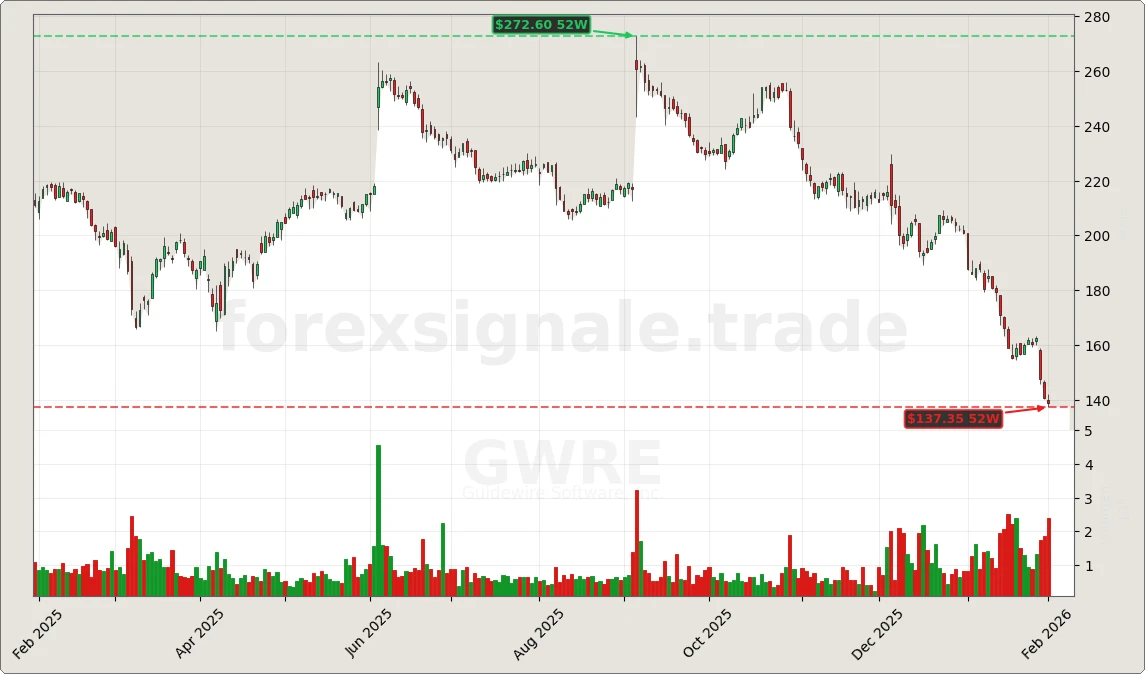

GWRE

Bearish

72%

Bearish

72%

BTCUSD

Bearish

72%

Bearish

72%

SOLUSD

Bearish

72%

Bearish

72%

ADAUSD

Bearish

72%

Bearish

72%

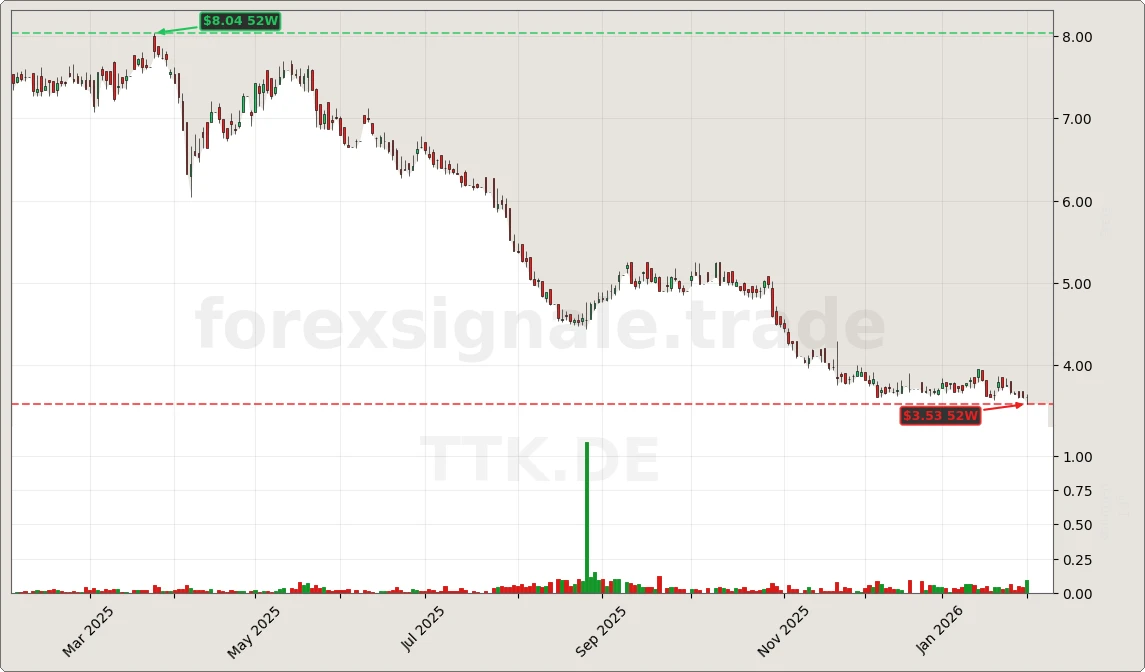

TTK.DE

Bearish

70%

Bearish

70%

TYL

Bearish

65%

Bearish

65%

XLP

Bullish

65%

Bullish

65%

DOC

Bearish

65%

Bearish

65%

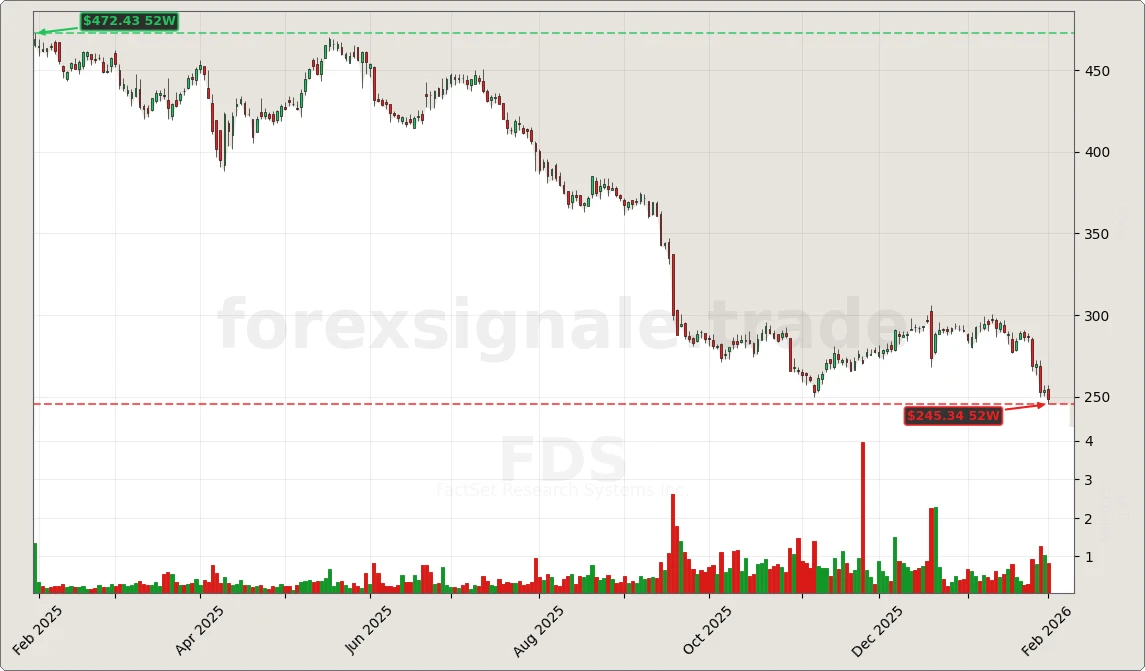

FDS

Bearish

65%

Bearish

65%

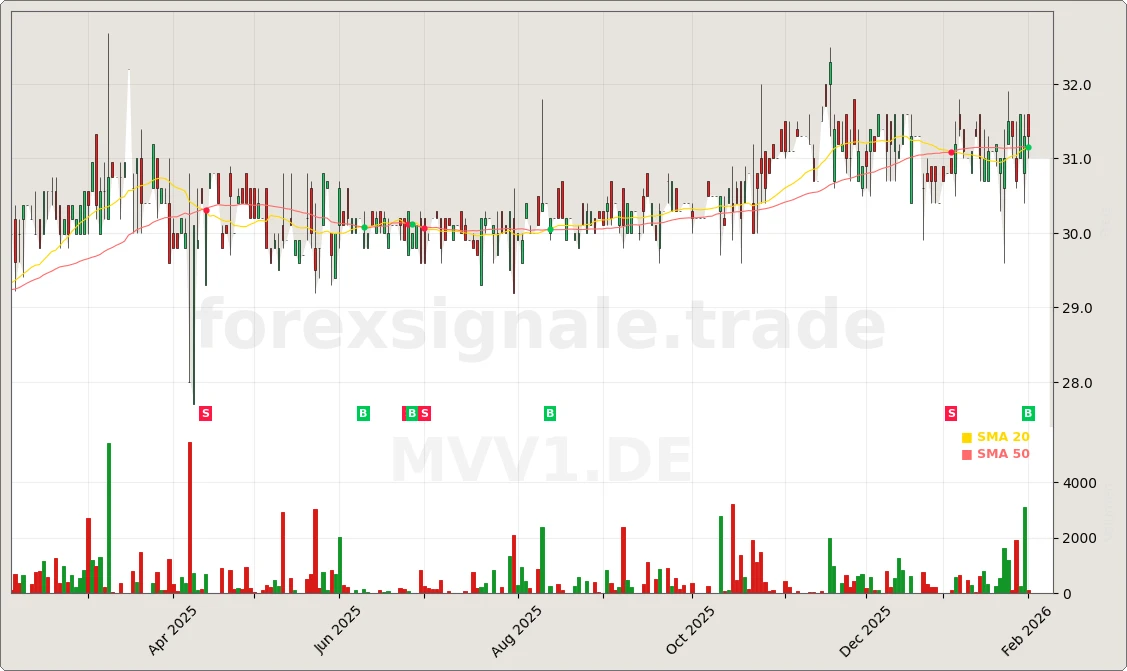

MVV1.DE

Bullish

65%

Bullish

65%

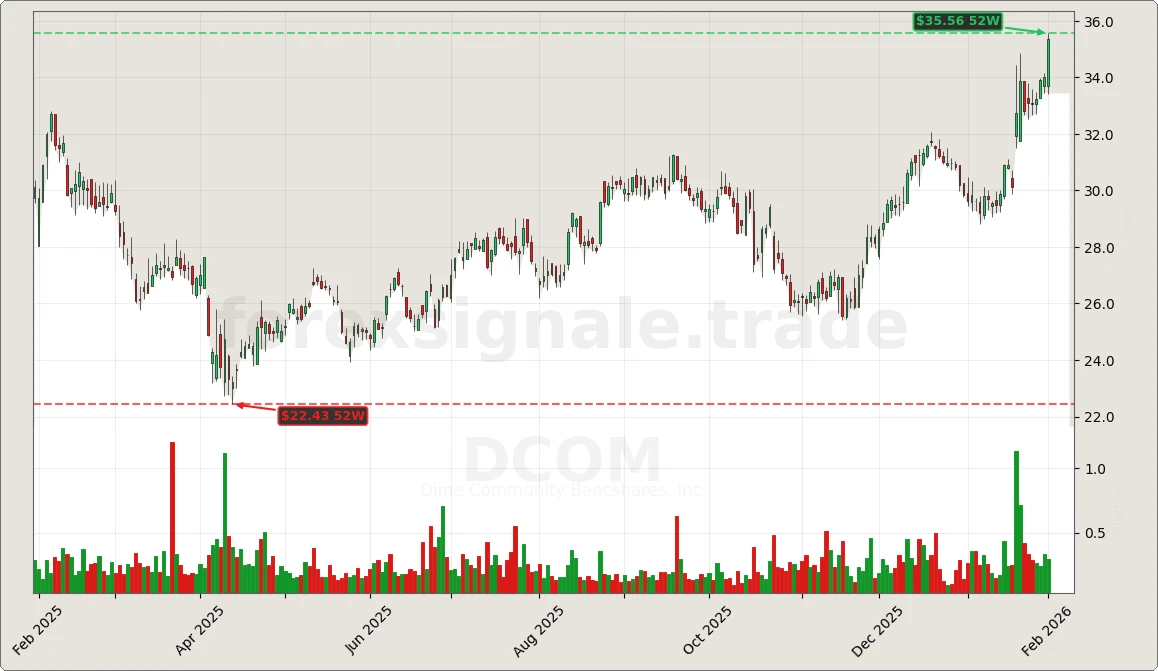

DCOM

Bullish

65%

Bullish

65%

ASAN

Bearish

65%

Bearish

65%

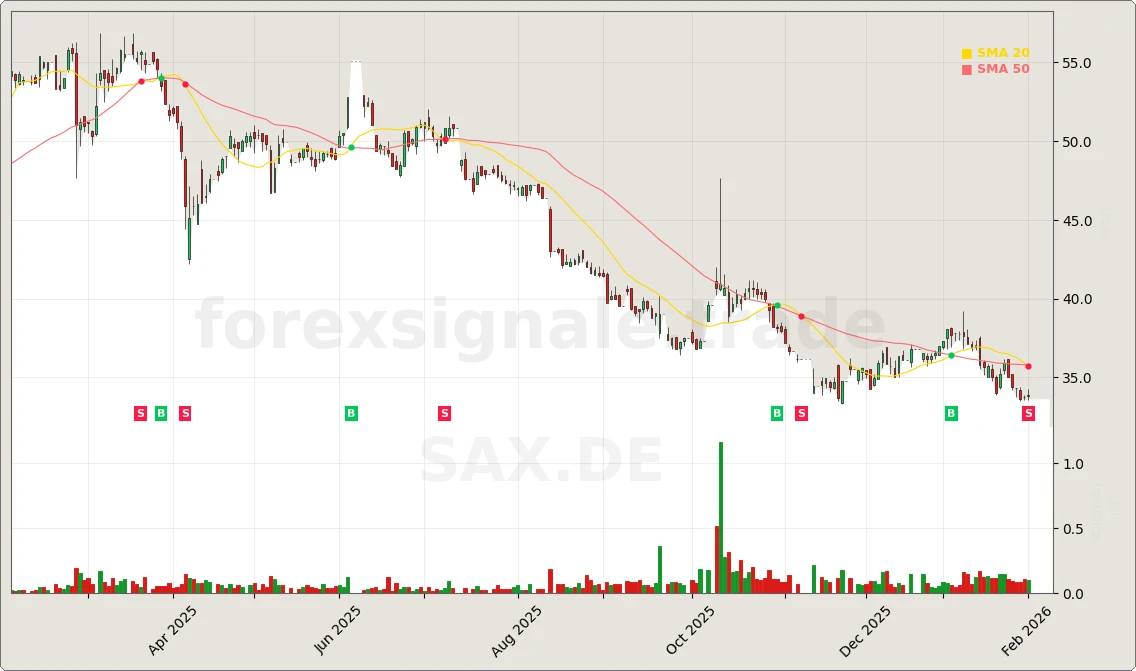

SAX.DE

Bearish

65%

Bearish

65%

ALGN

Bullish

65%

Bullish

65%

WMT

Bullish

65%

Bullish

65%

TEAM

Bearish

65%

Bearish

65%

USB

Bullish

65%

Bullish

65%

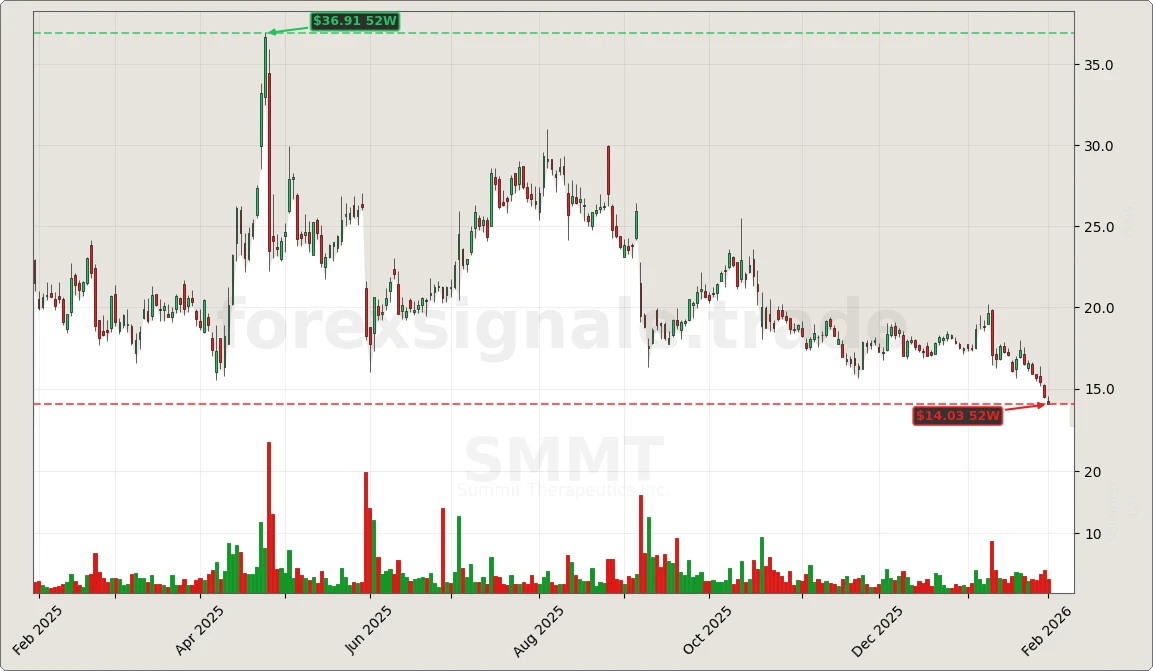

SMMT

Bearish

65%

Bearish

65%

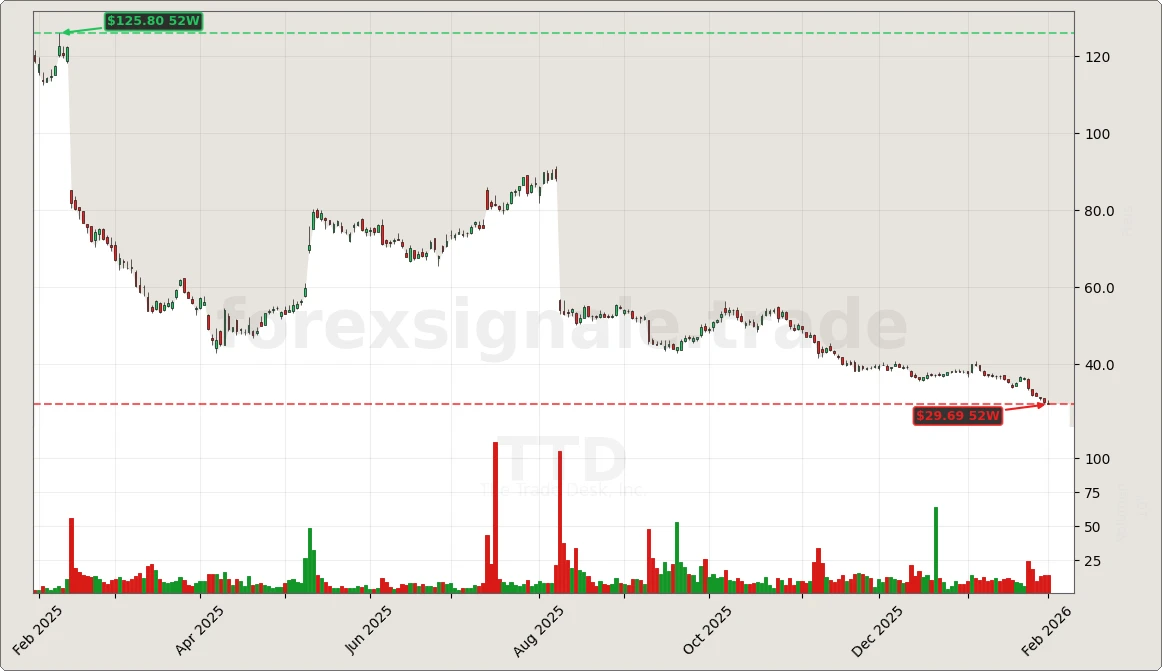

TTD

Bearish

65%

Bearish

65%

TXN

Bullish

65%

Bullish

65%

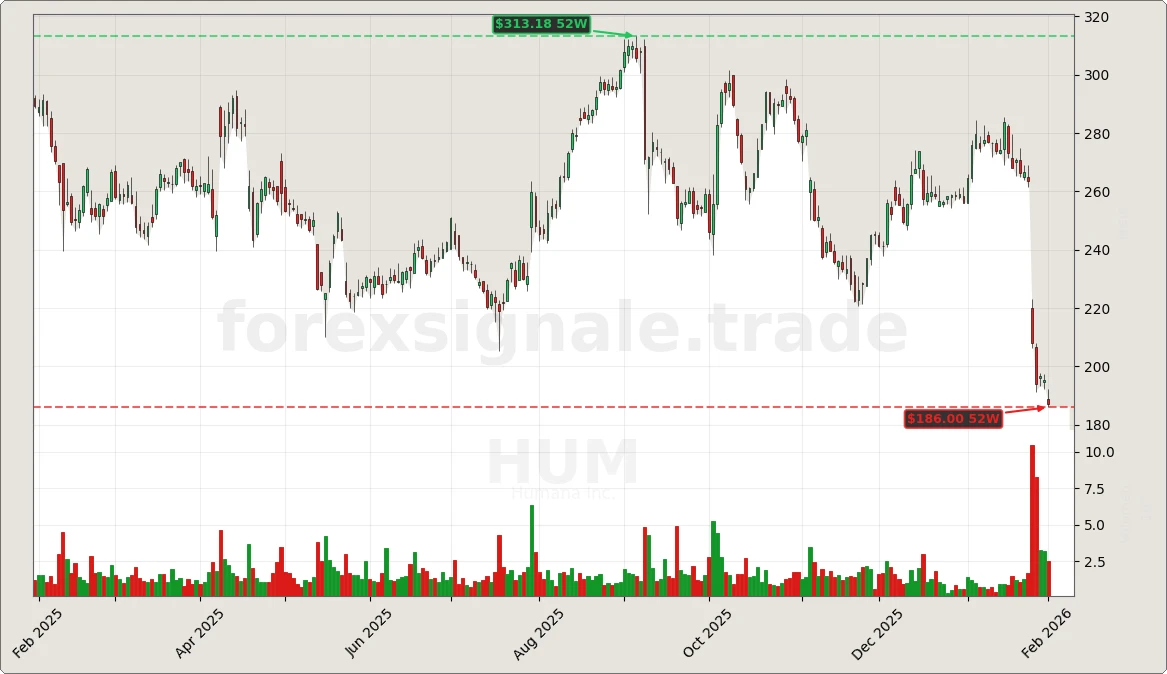

HUM

Bearish

65%

Bearish

65%

UCG.MI

Bullish

65%

Bullish

65%

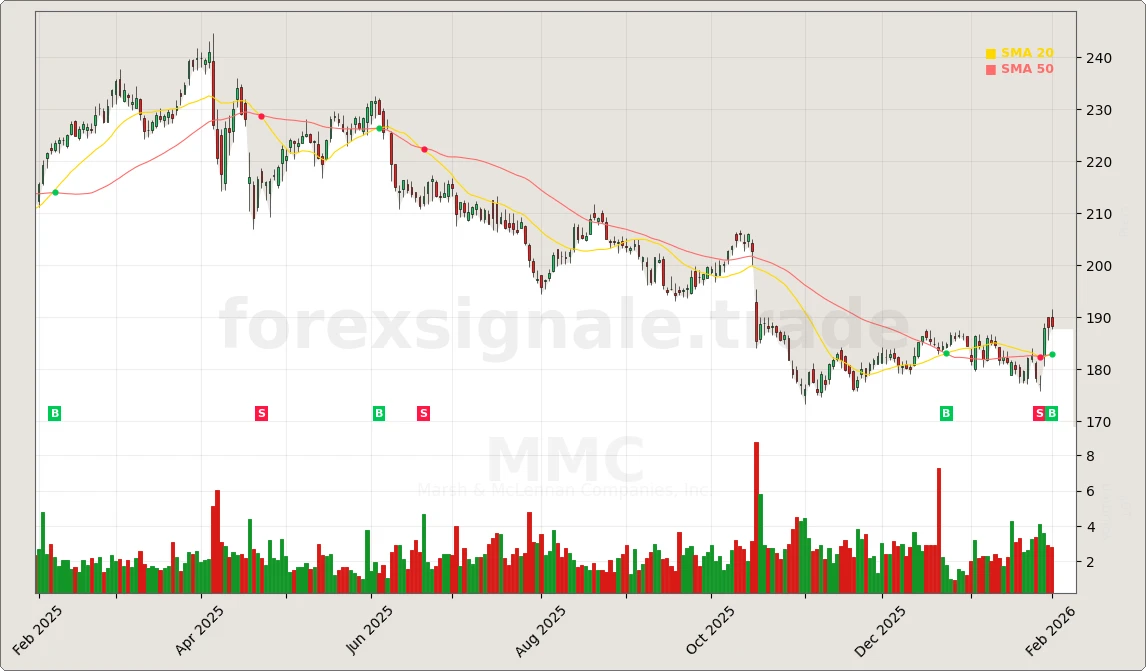

MMC

Bullish

65%

Bullish

65%

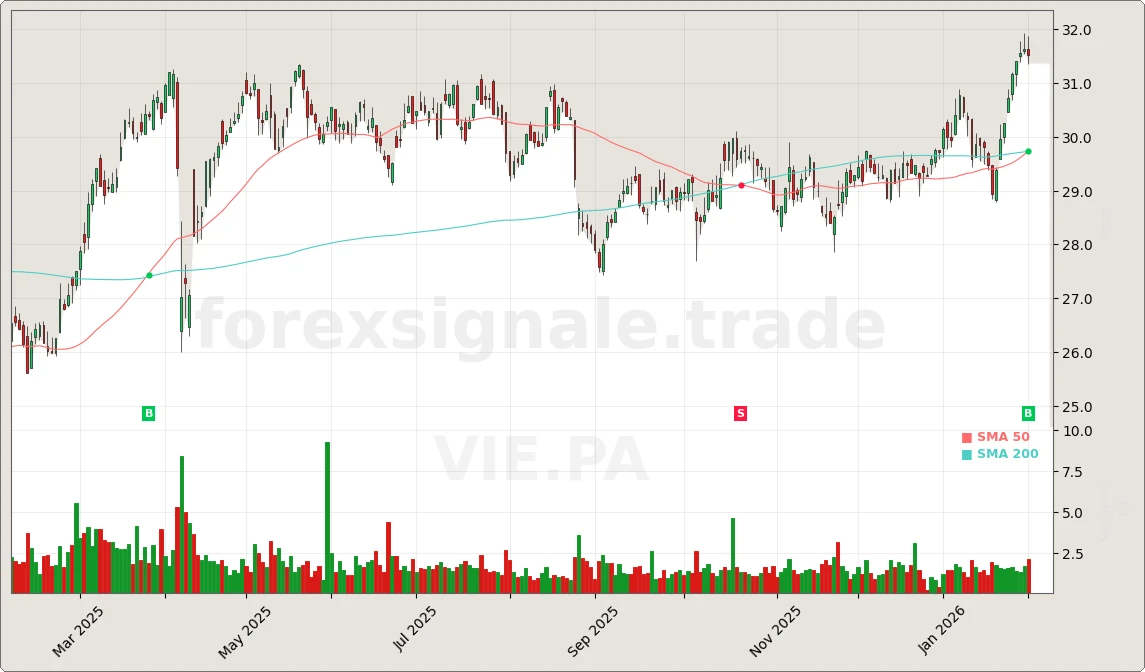

VIE.PA

Bullish

65%

Bullish

65%

HYQ.DE

Bearish

65%

Bearish

65%

ABR

Bearish

65%

Bearish

65%

ABI.BR

Bullish

65%

Bullish

65%

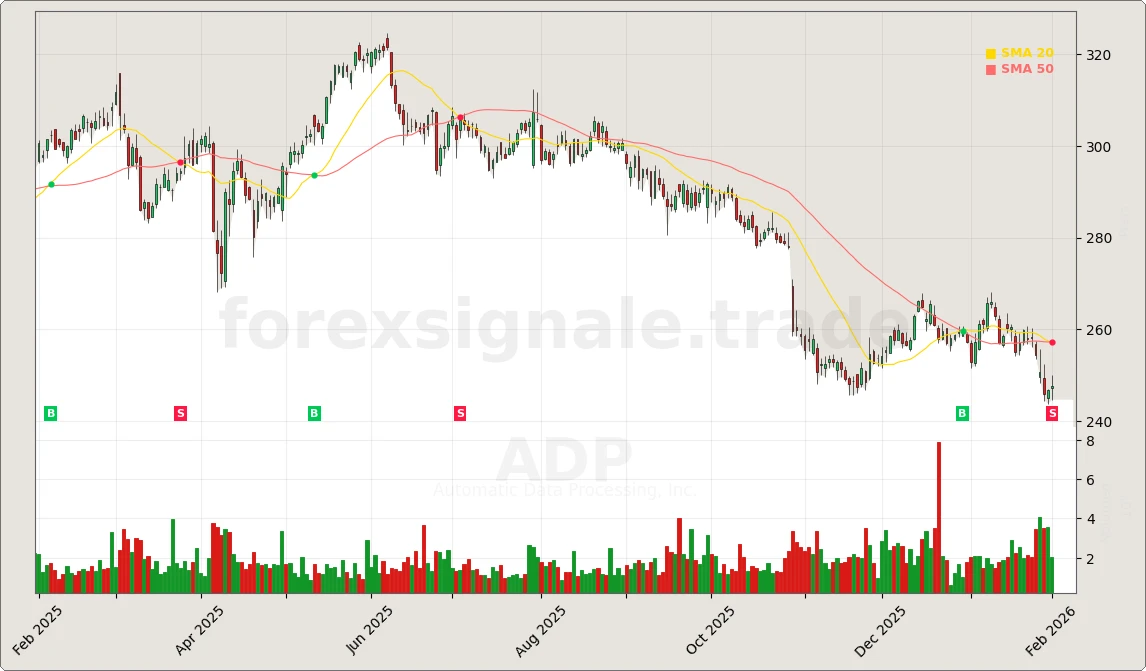

ADP

Bearish

65%

Bearish

65%

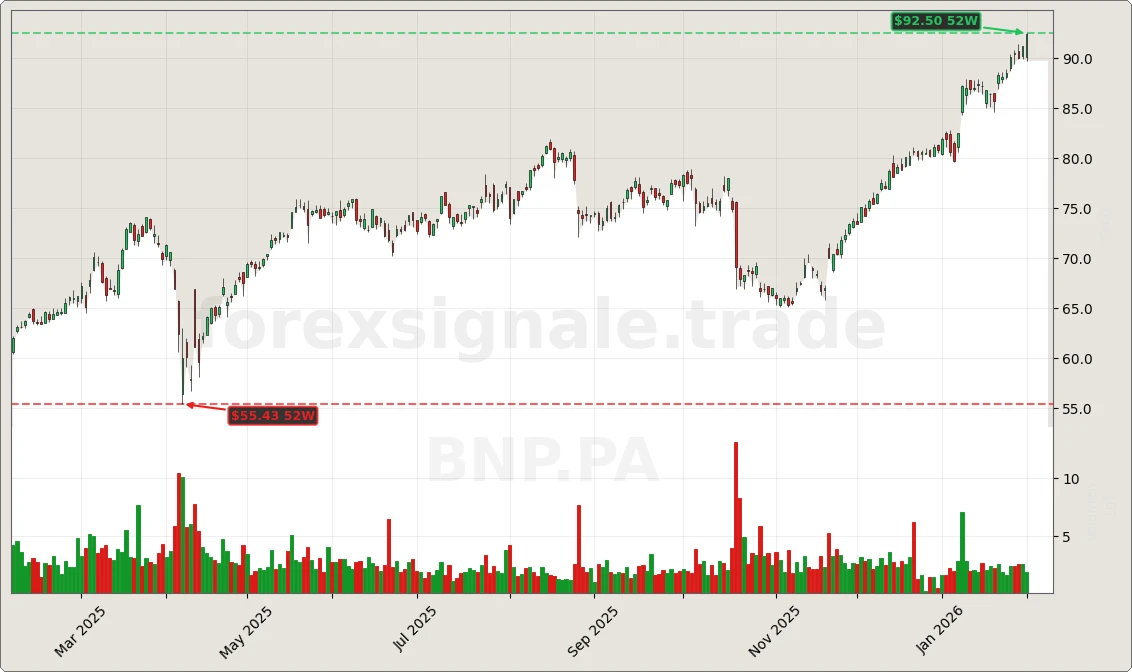

BNP.PA

Bullish

65%

Bullish

65%

CSCO

Bullish

65%

Bullish

65%

FPE3.DE

Bearish

62%

Bearish

62%

DIS

Bearish

60%

Bearish

60%

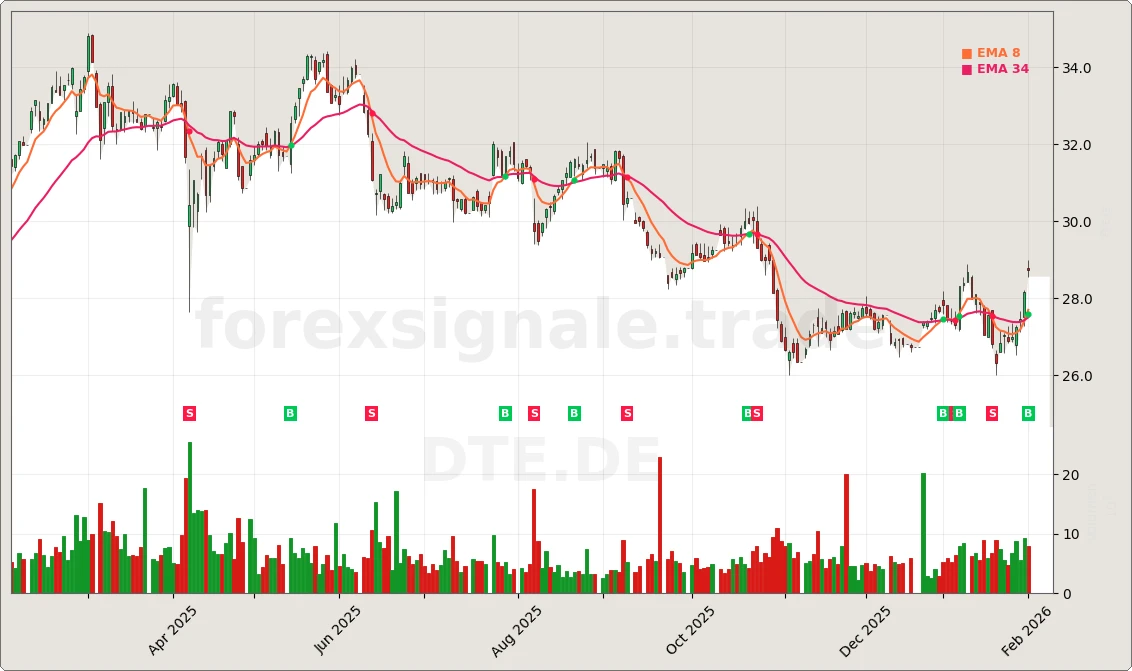

DTE.DE

Bullish

60%

Bullish

60%

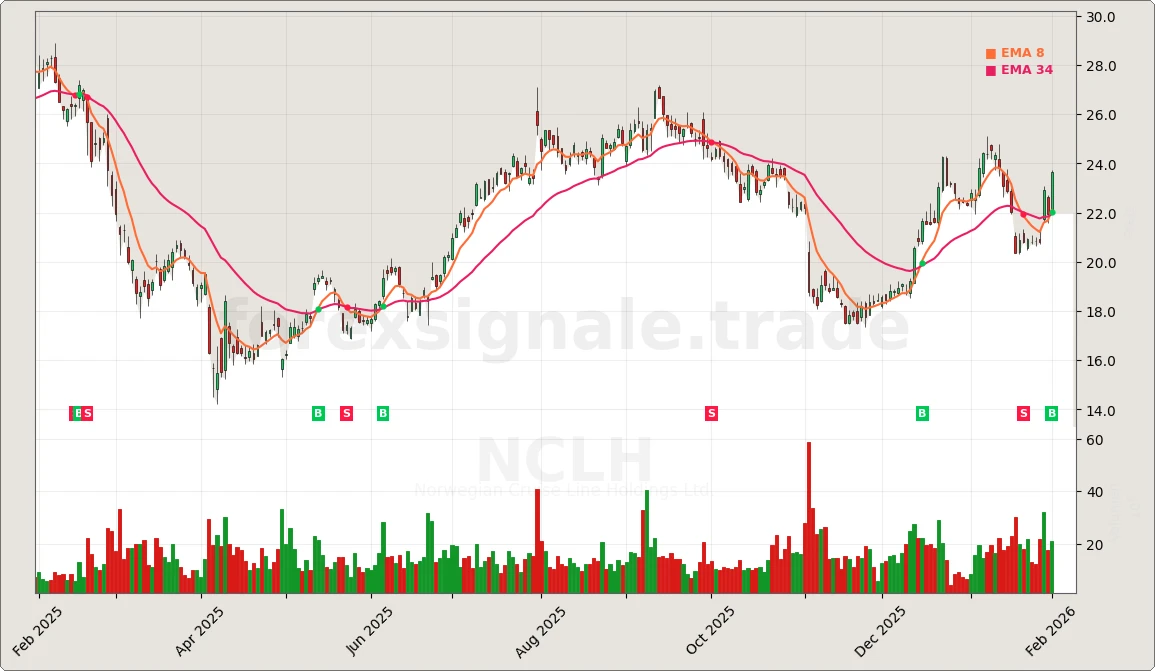

NCLH

Bullish

60%

Bullish

60%

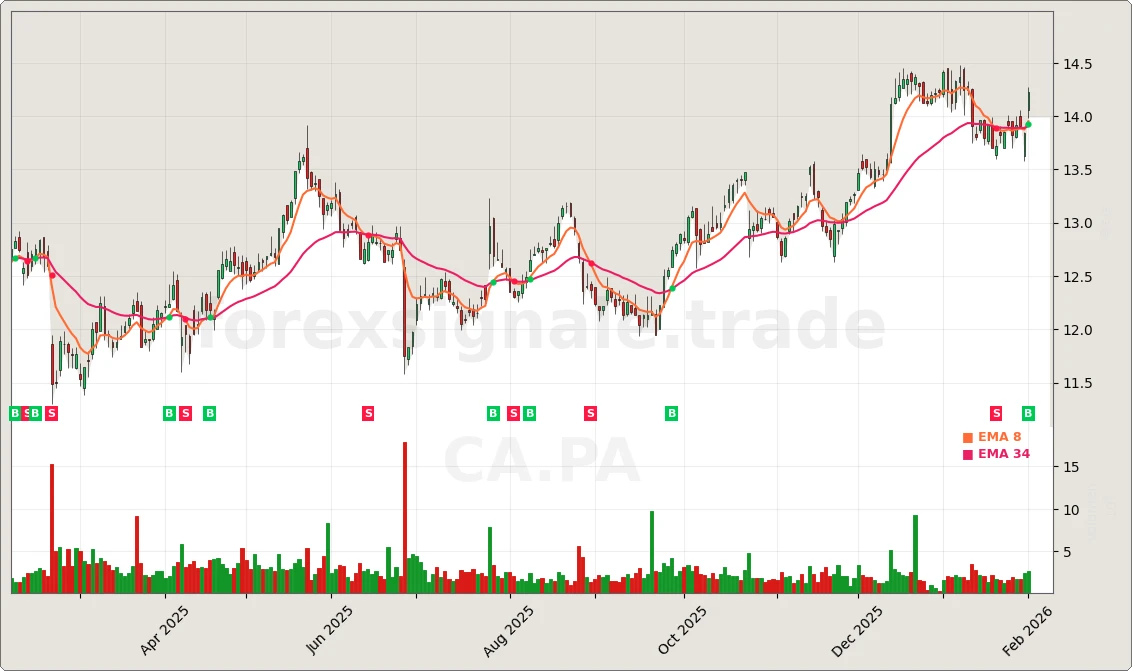

CA.PA

Bullish

60%

Bullish

60%

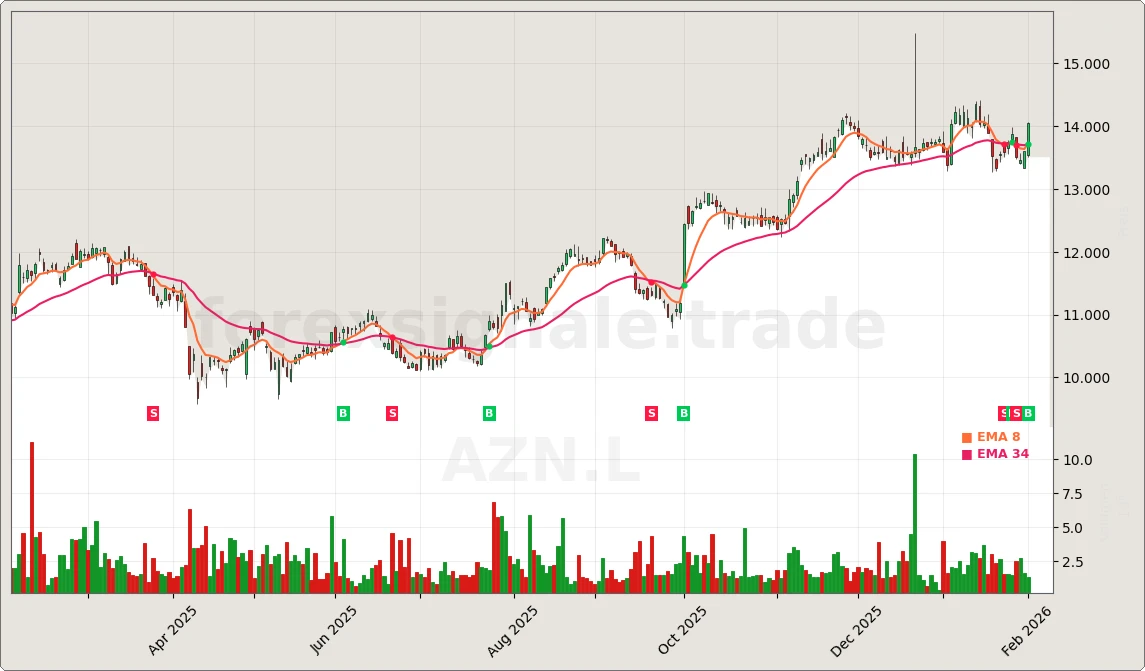

AZN.L

Bullish

60%

Bullish

60%

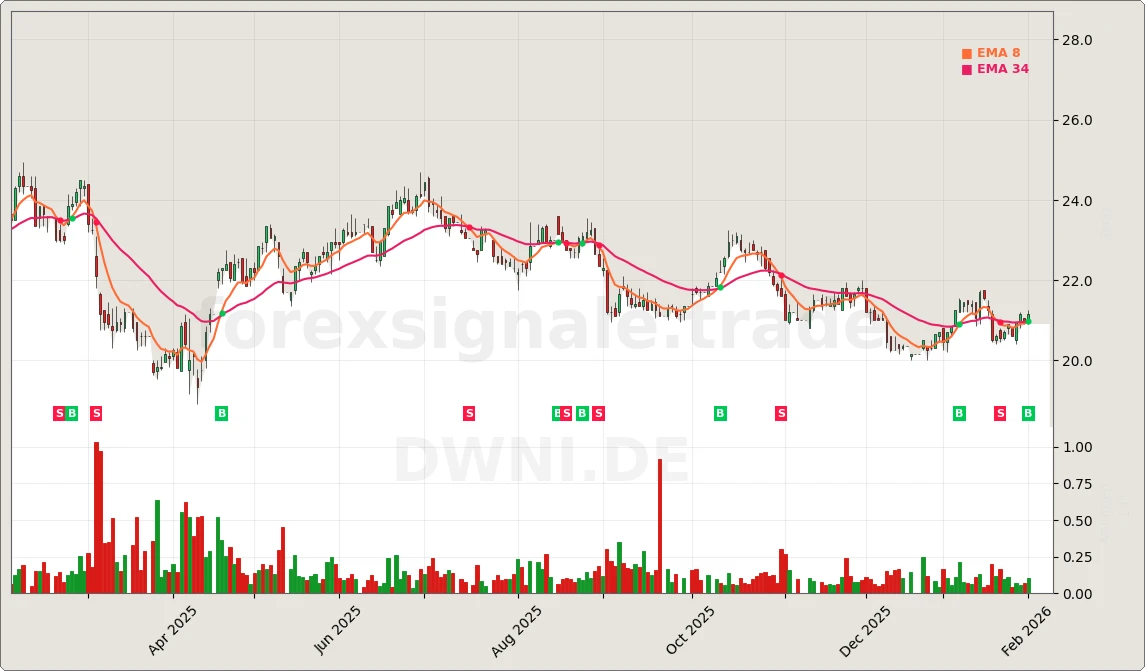

DWNI.DE

Bullish

60%

Bullish

60%

APYX

Bullish

60%

Bullish

60%

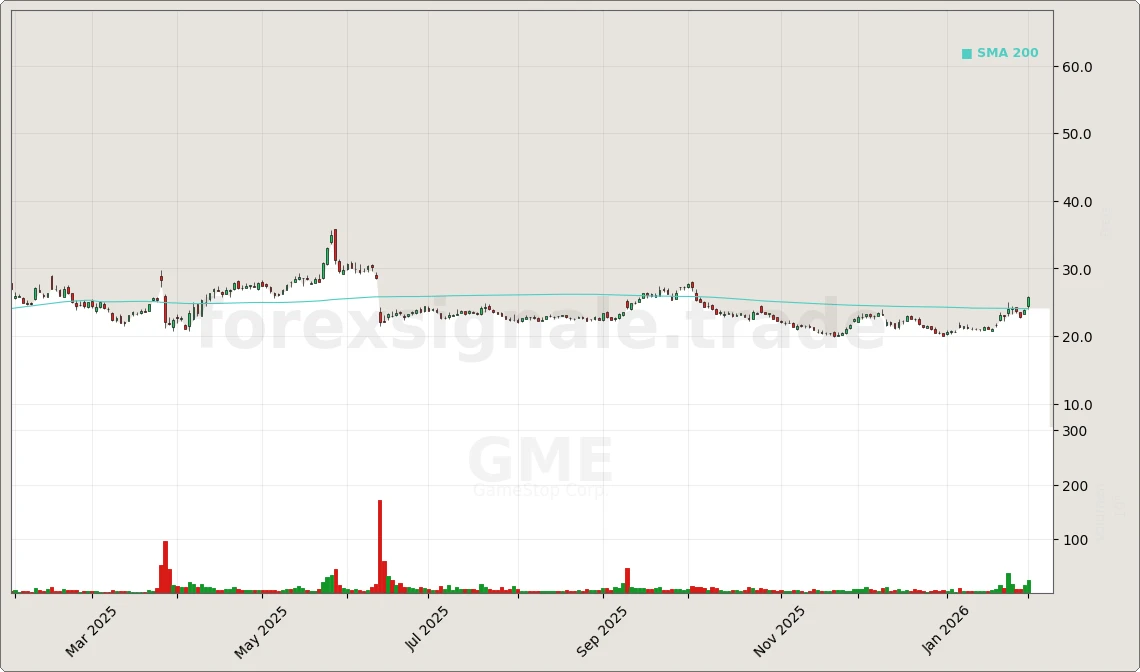

GME

Bullish

60%

Bullish

60%

NG.L

Bullish

55%

Bullish

55%

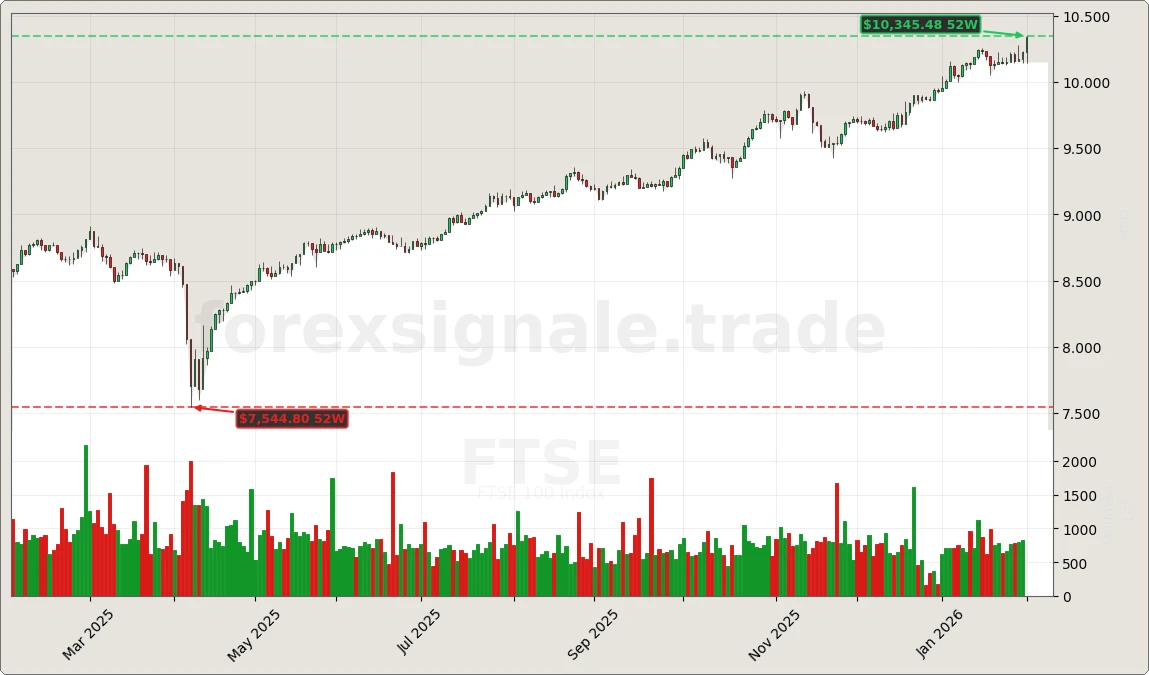

FTSE

Bullish

55%

Bullish

55%

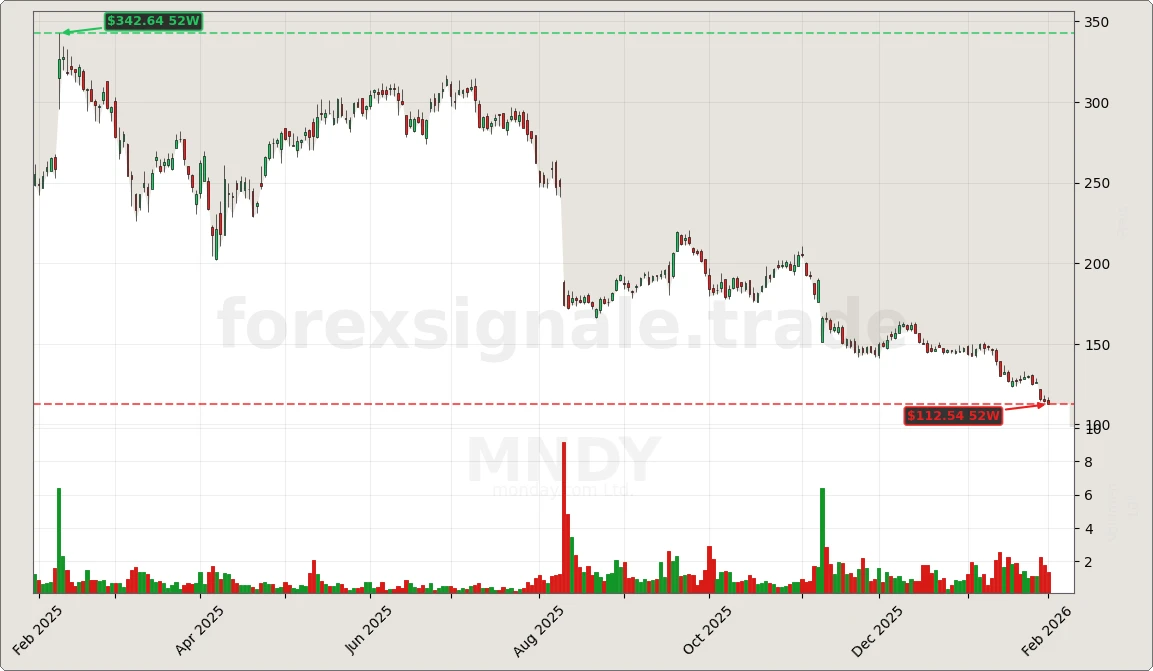

MNDY

Bearish

55%

Bearish

55%

MRK

Bullish

55%

Bullish

55%

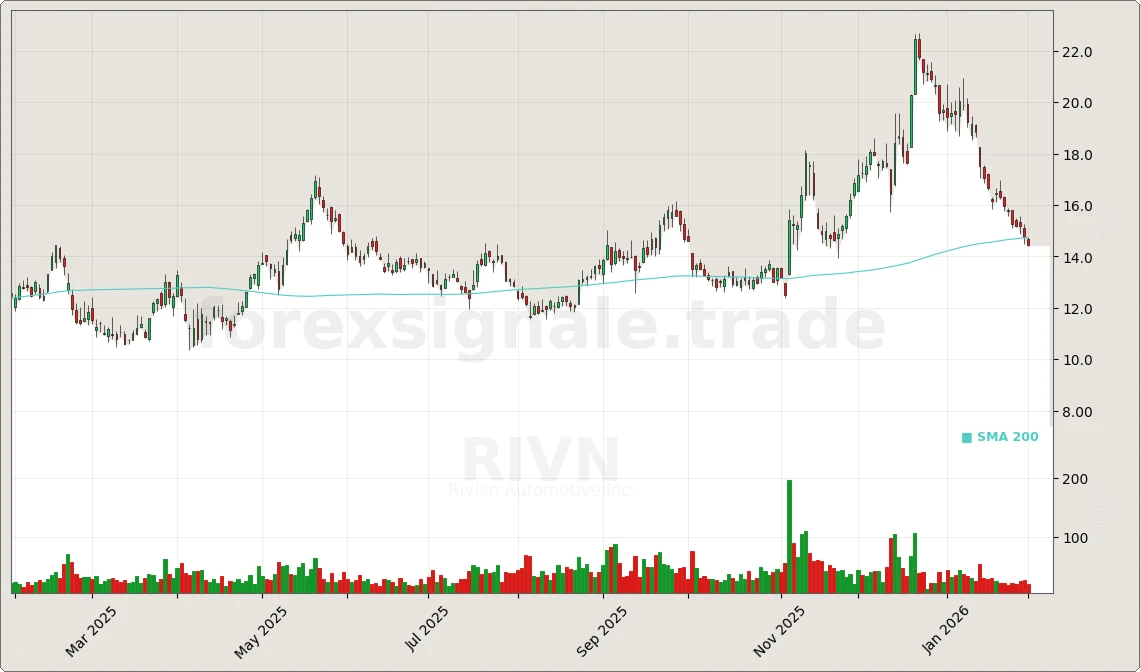

RIVN

Bearish

55%

Bearish

55%

WUW.DE

Bullish

55%

Bullish

55%

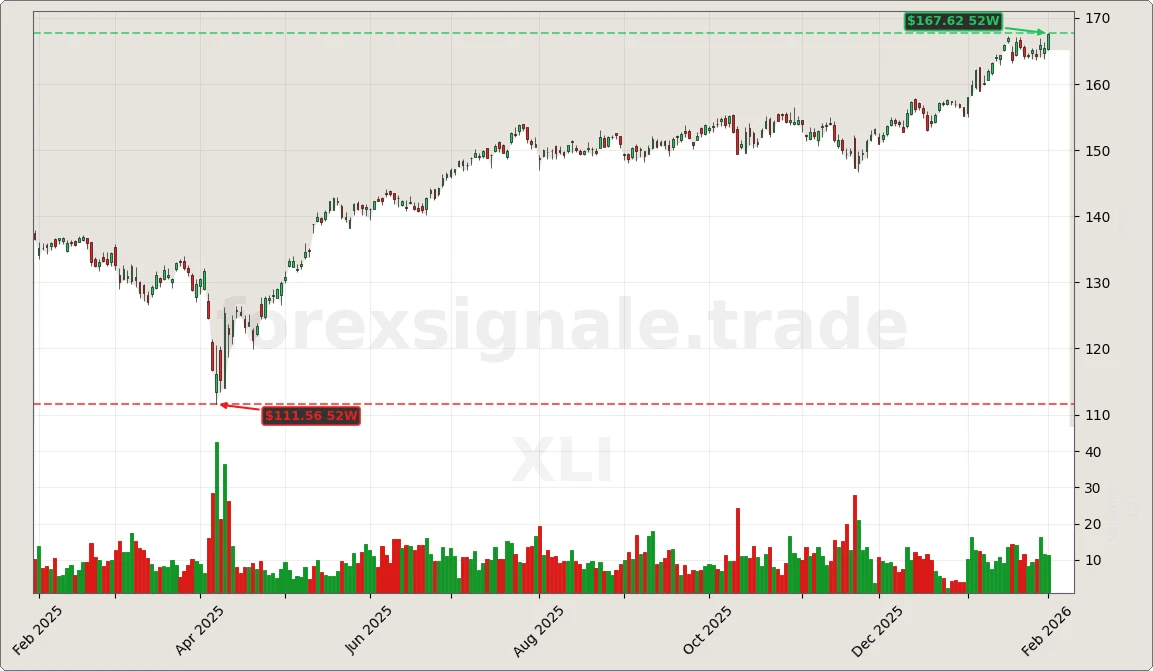

XLI

Bullish

55%

Bullish

55%

CHWY

Bearish

55%

Bearish

55%

CSX

Bullish

55%

Bullish

55%

EXSA

Bullish

55%

Bullish

55%

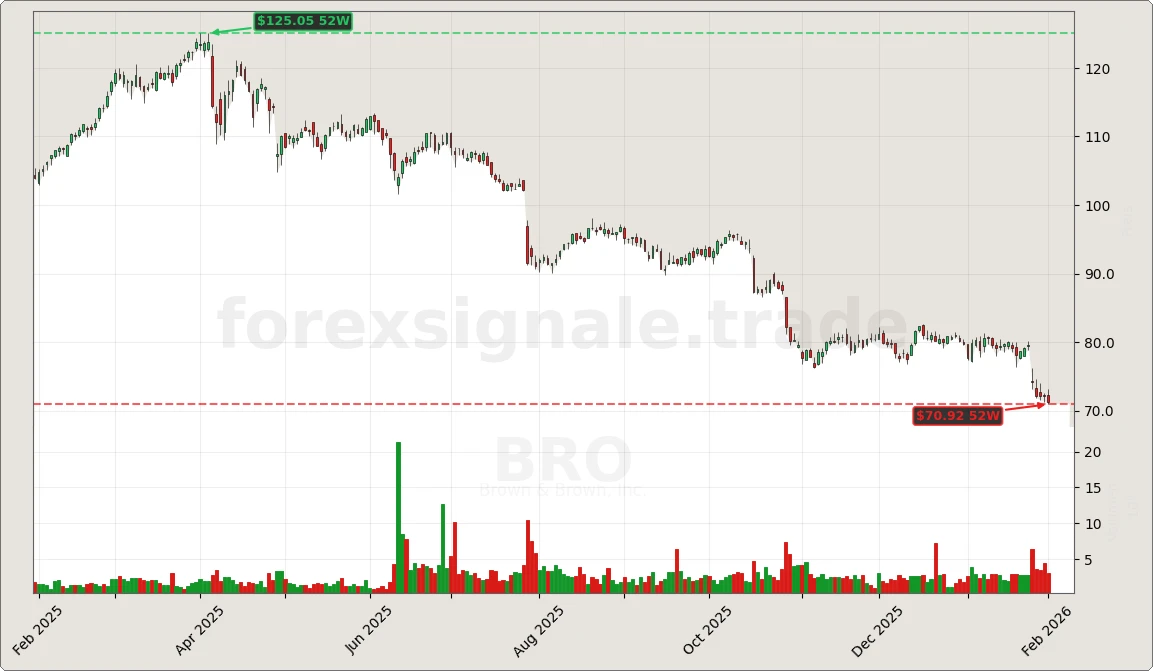

BRO

Bearish

55%

Bearish

55%

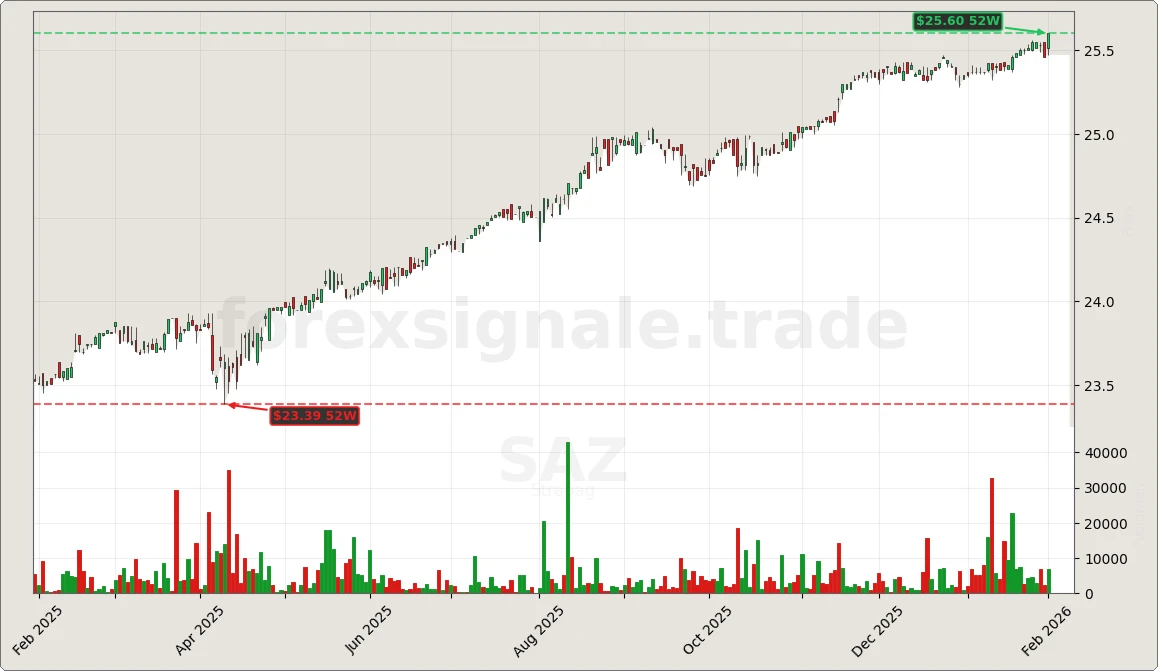

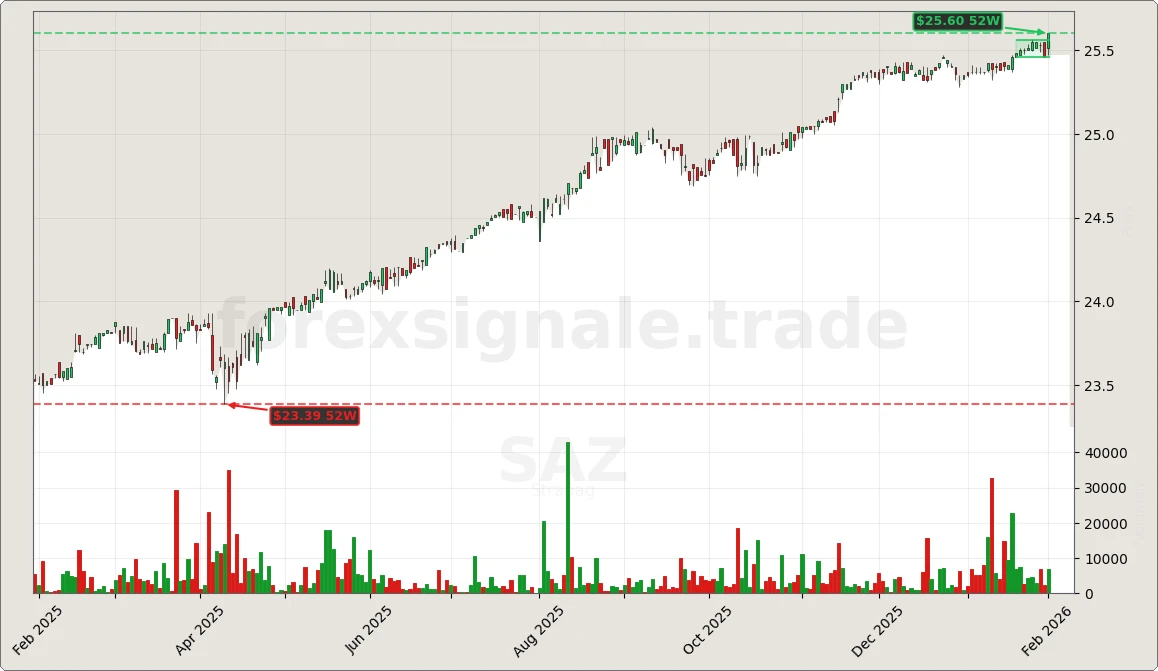

SAZ

Bullish

55%

Bullish

55%

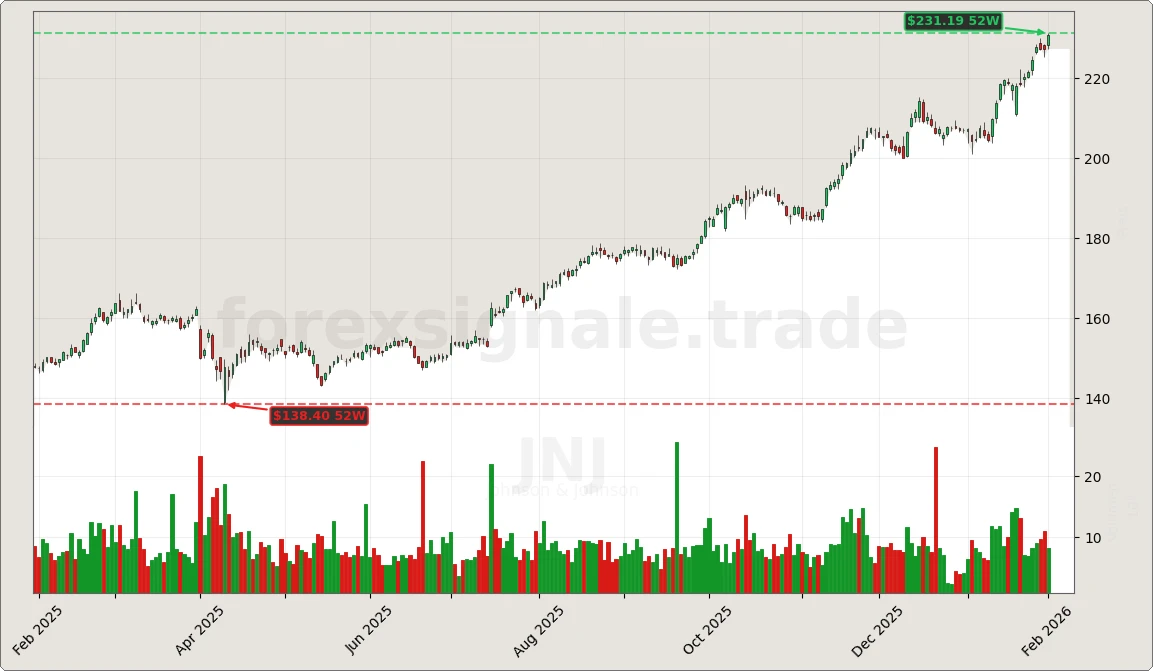

JNJ

Bullish

55%

Bullish

55%

ONB

Bullish

55%

Bullish

55%

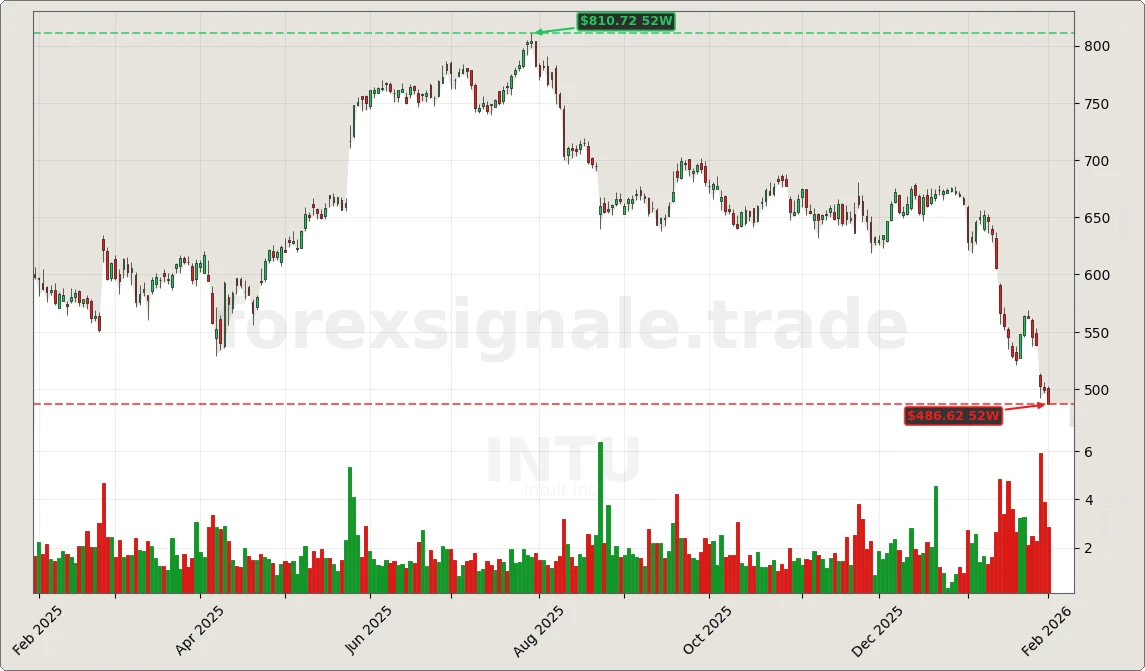

INTU

Bearish

55%

Bearish

55%

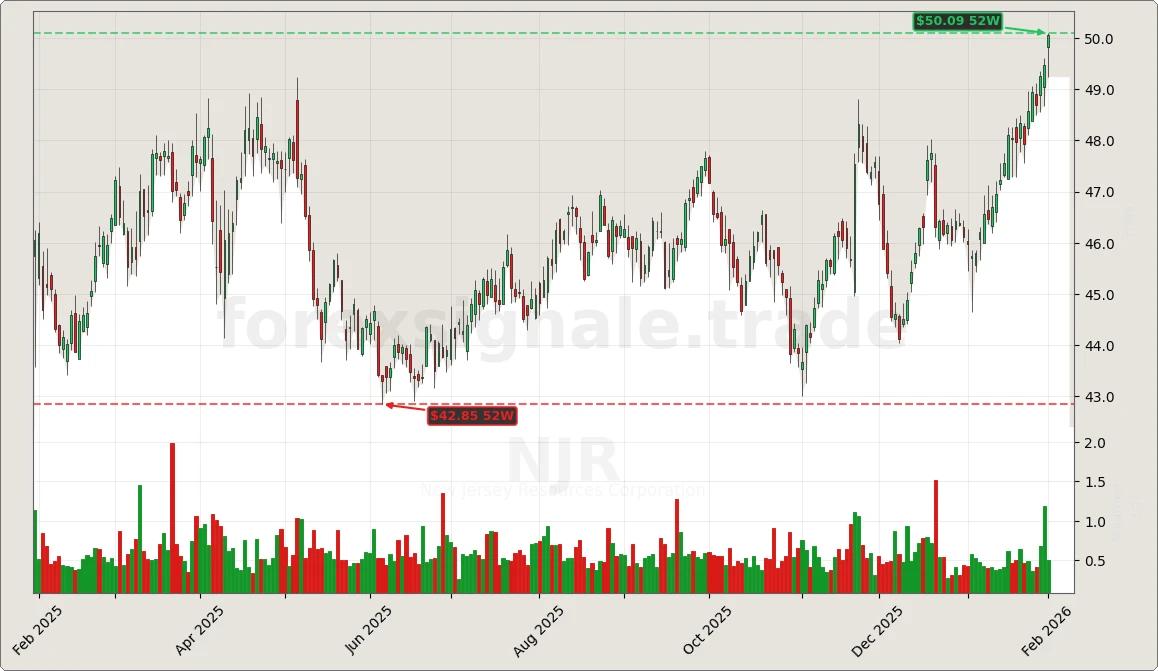

NJR

Bullish

55%

Bullish

55%

GOOG

Bullish

55%

Bullish

55%

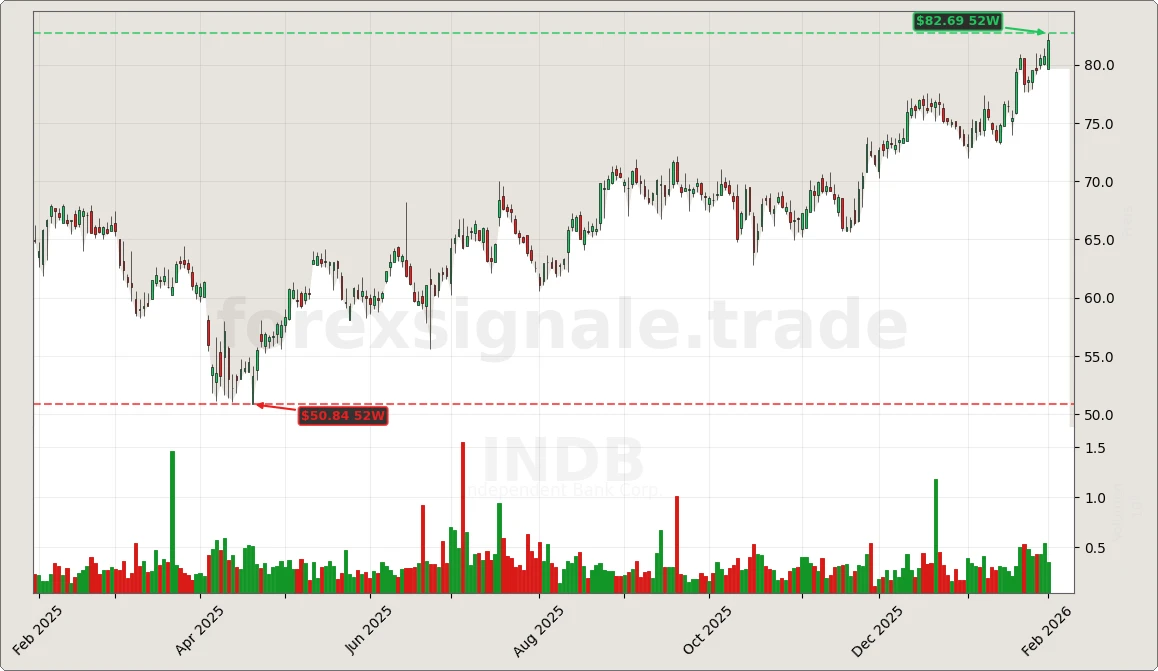

INDB

Bullish

55%

Bullish

55%

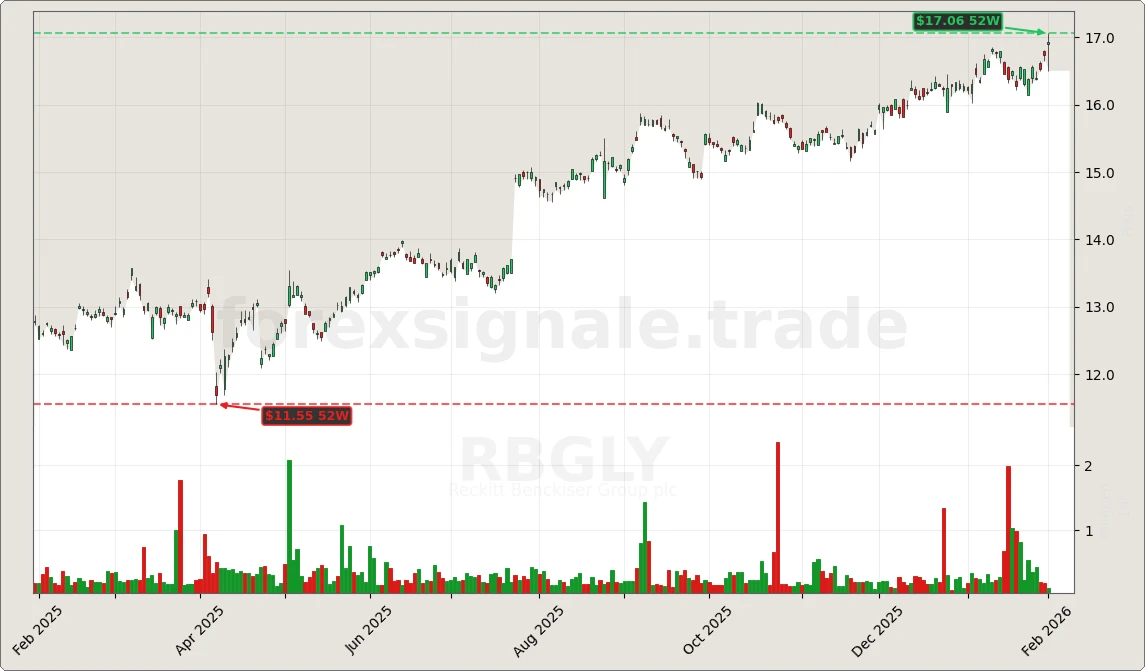

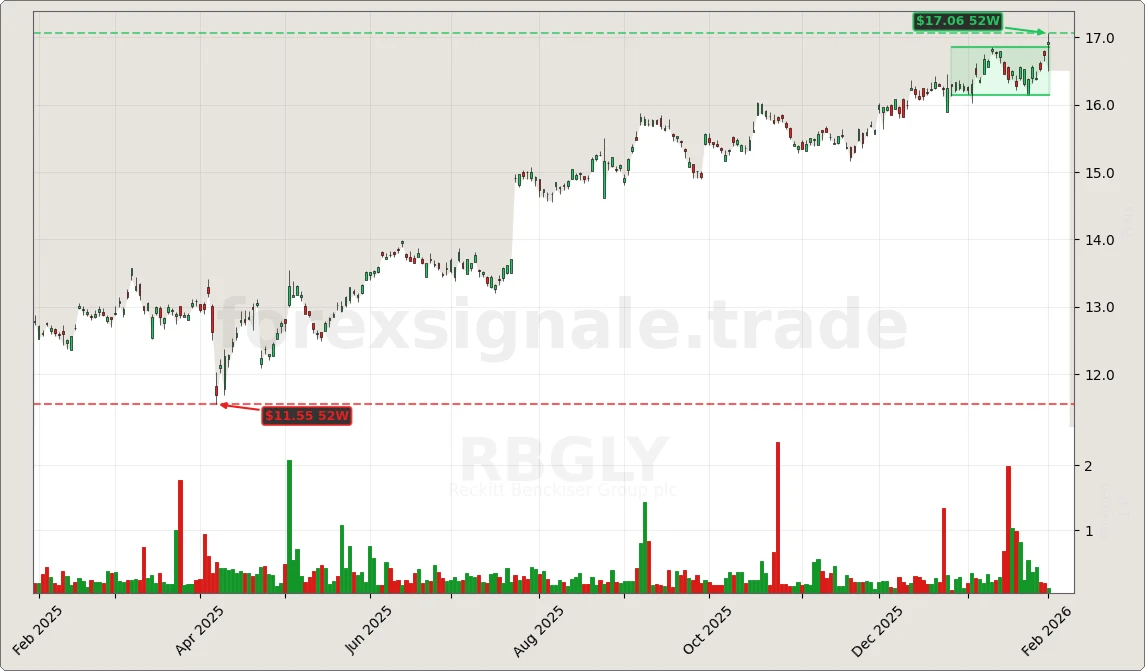

RBGLY

Bullish

55%

Bullish

55%

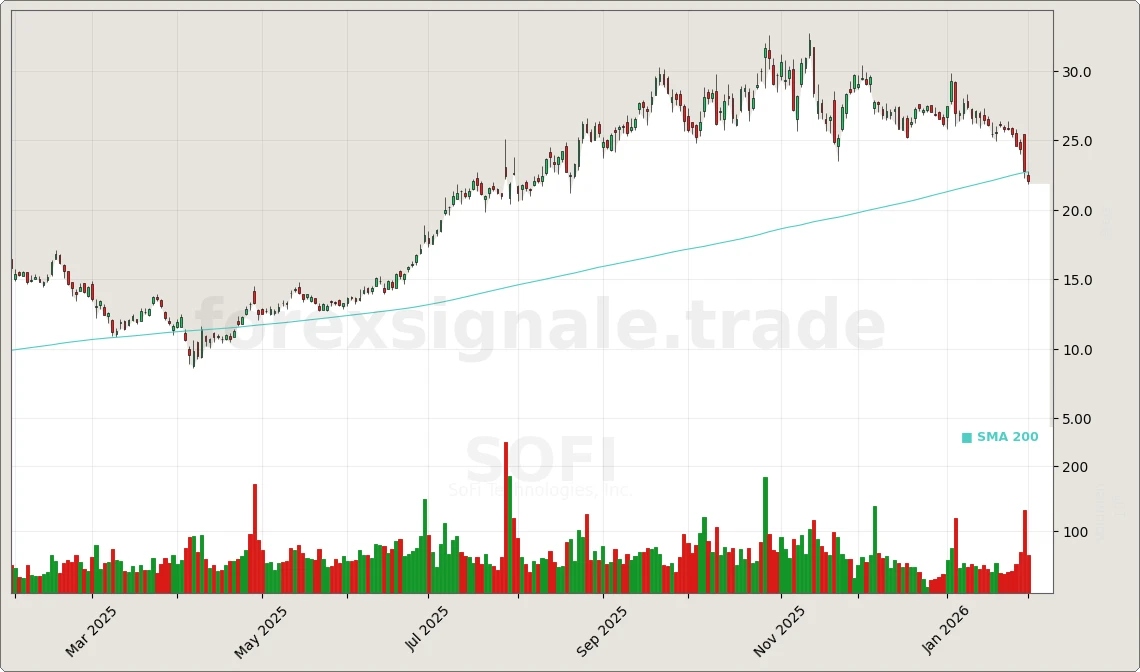

SOFI

Bearish

55%

Bearish

55%

INGA.AS

Bullish

55%

Bullish

55%

ELV

Bearish

55%

Bearish

55%

KO

Bullish

55%

Bullish

55%

CLVT

Bearish

55%

Bearish

55%

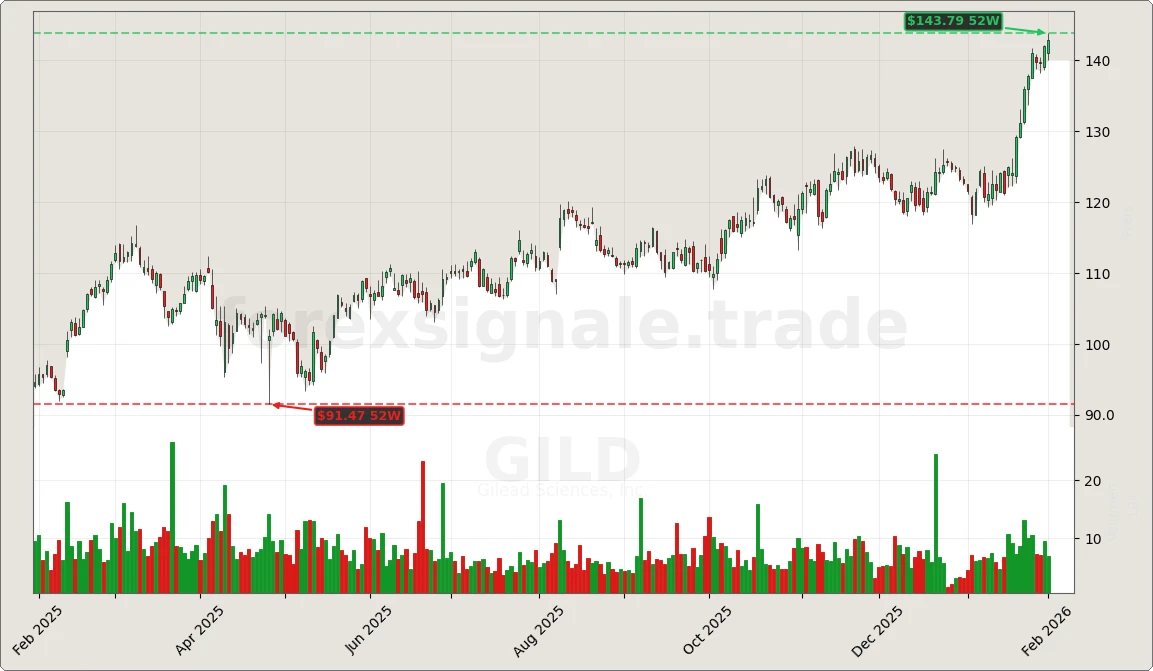

GILD

Bullish

55%

Bullish

55%

GOOGL

Bullish

55%

Bullish

55%

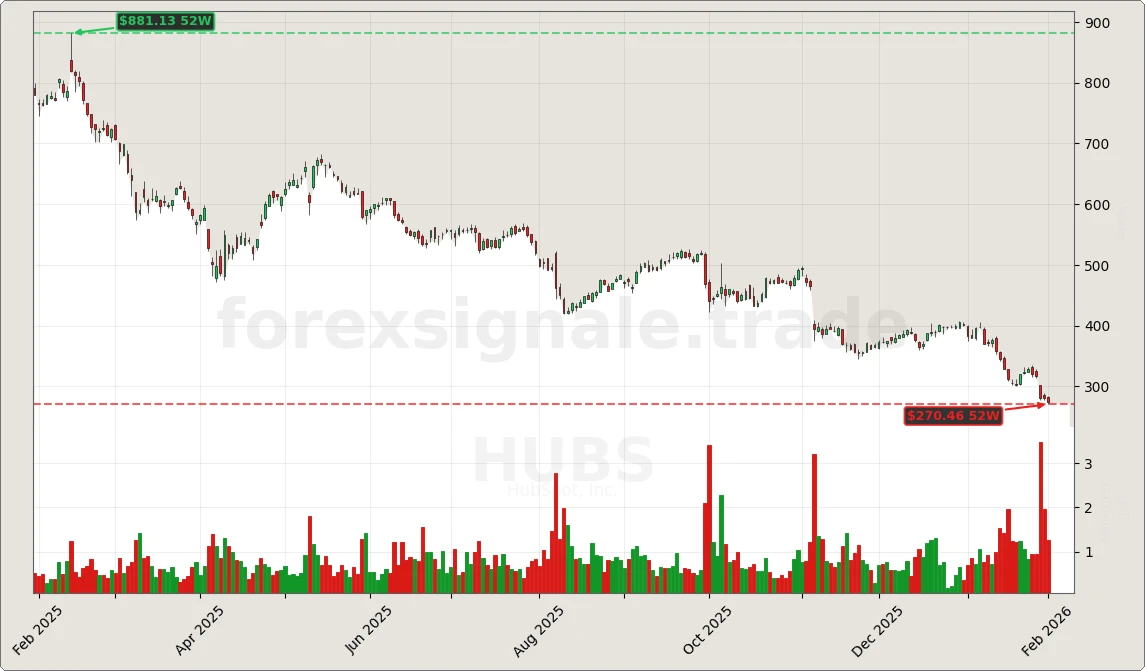

HUBS

Bearish

55%

Bearish

55%

OIL

Bearish

55%

Bearish

55%

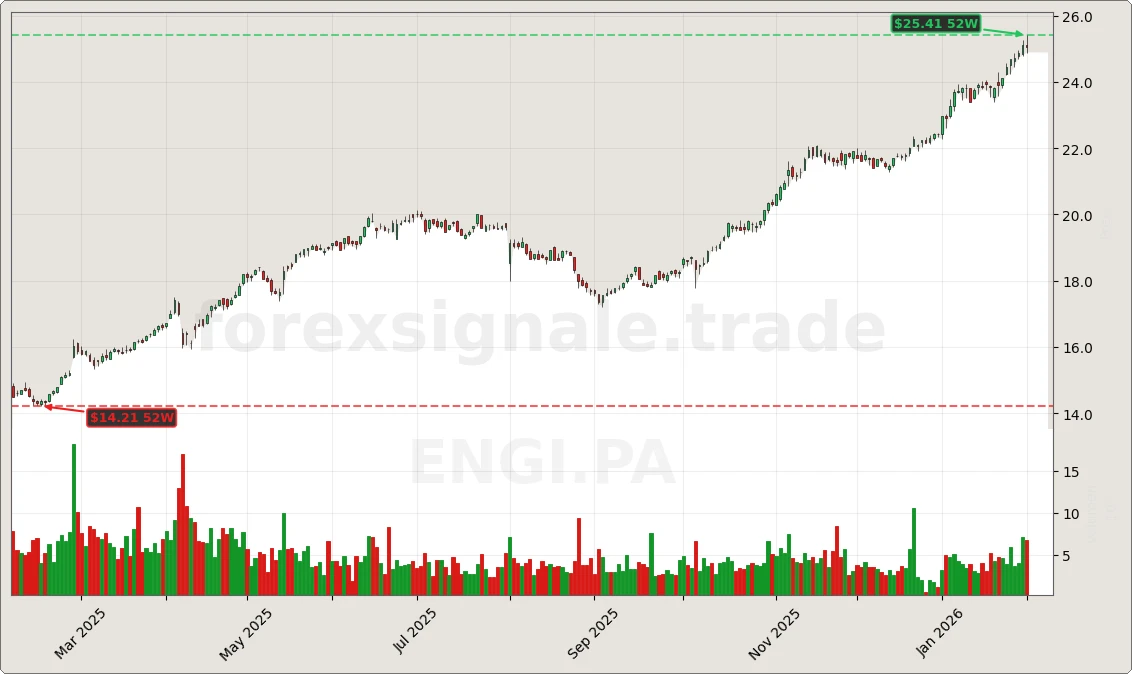

ENGI.PA

Bullish

52%

Bullish

52%

ESTC

Bearish

52%

Bearish

52%

VZ

Bullish

52%

Bullish

52%

INH.DE

Bullish

52%

Bullish

52%

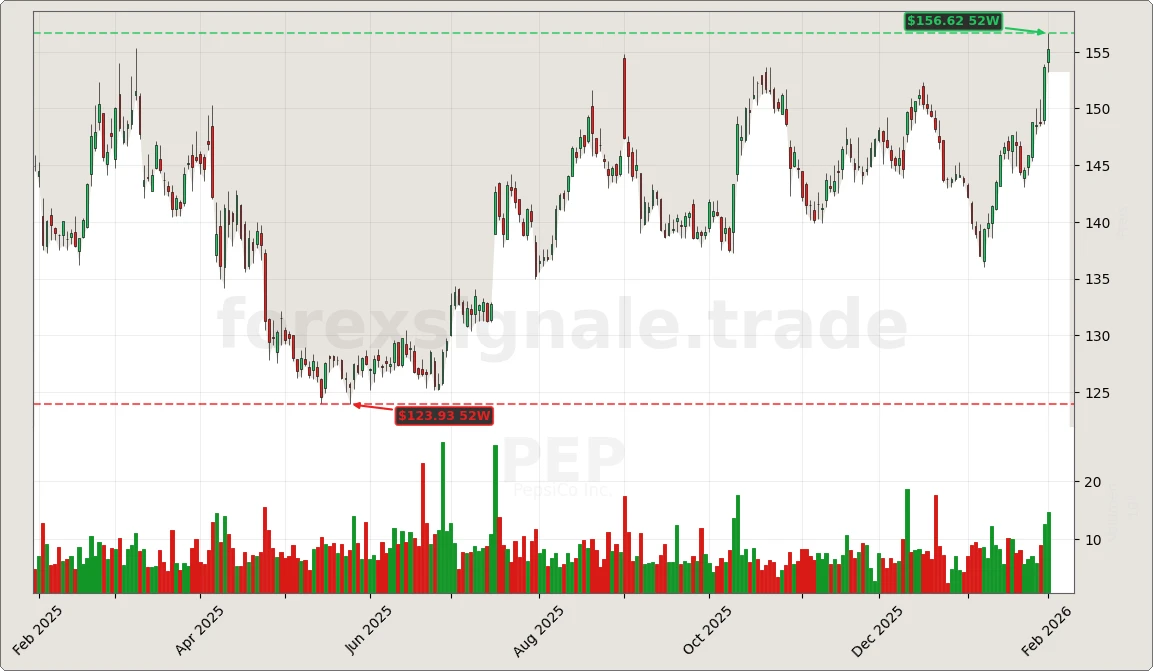

PEP

Bullish

52%

Bullish

52%

GMM.DE

Bullish

52%

Bullish

52%

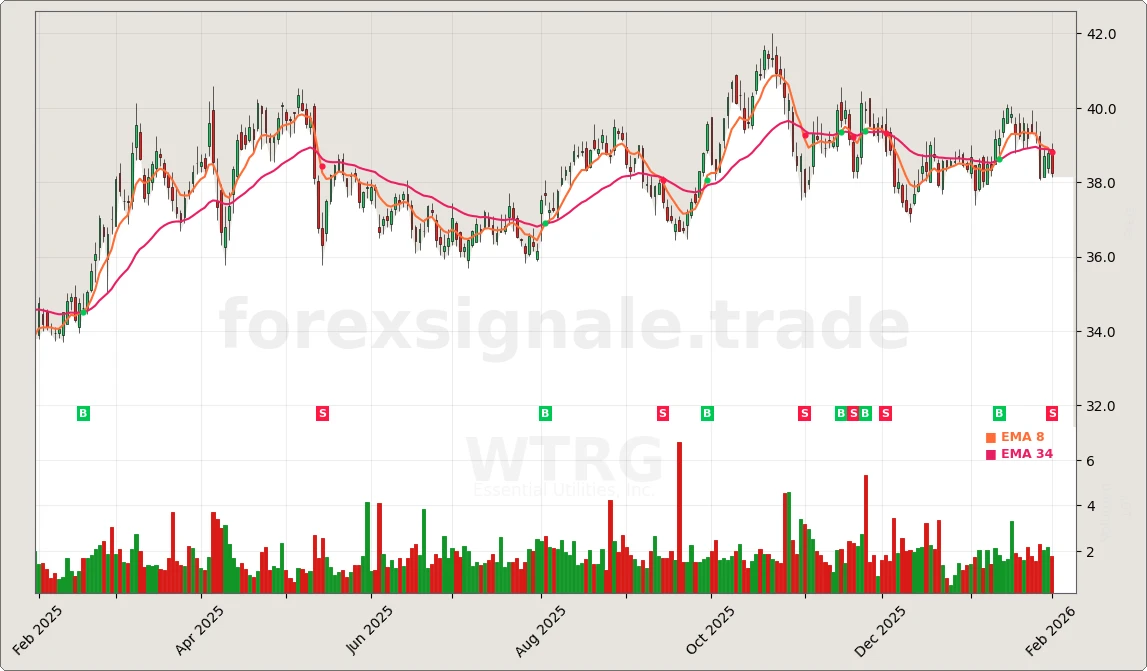

WTRG

Bearish

50%

Bearish

50%

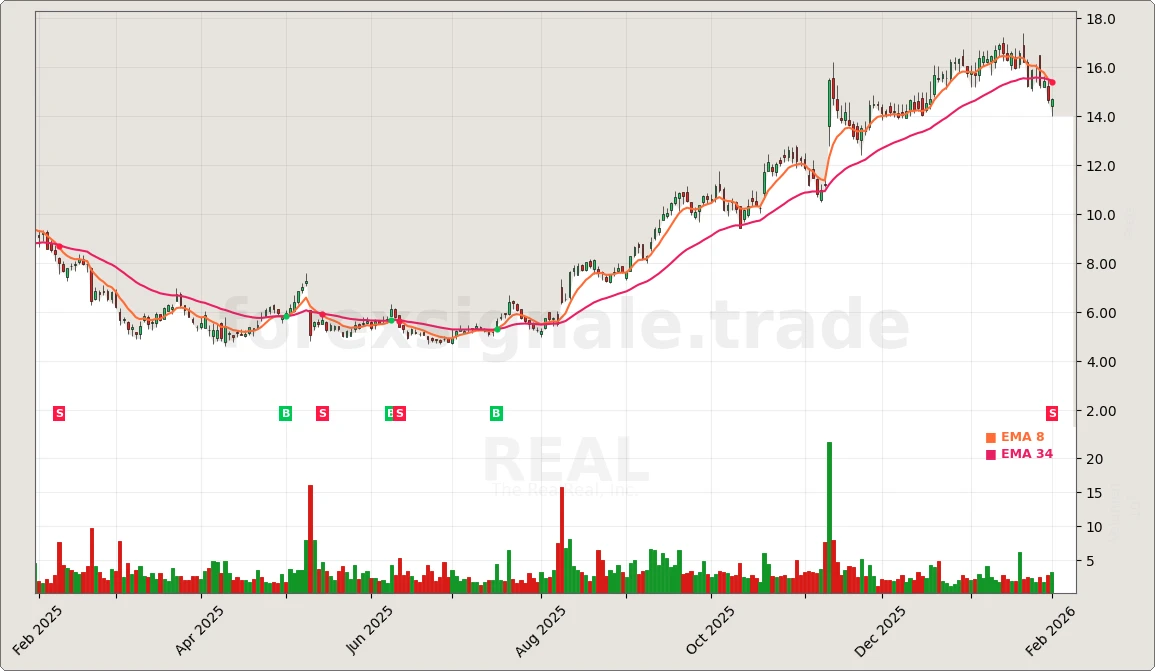

REAL

Bearish

50%

Bearish

50%

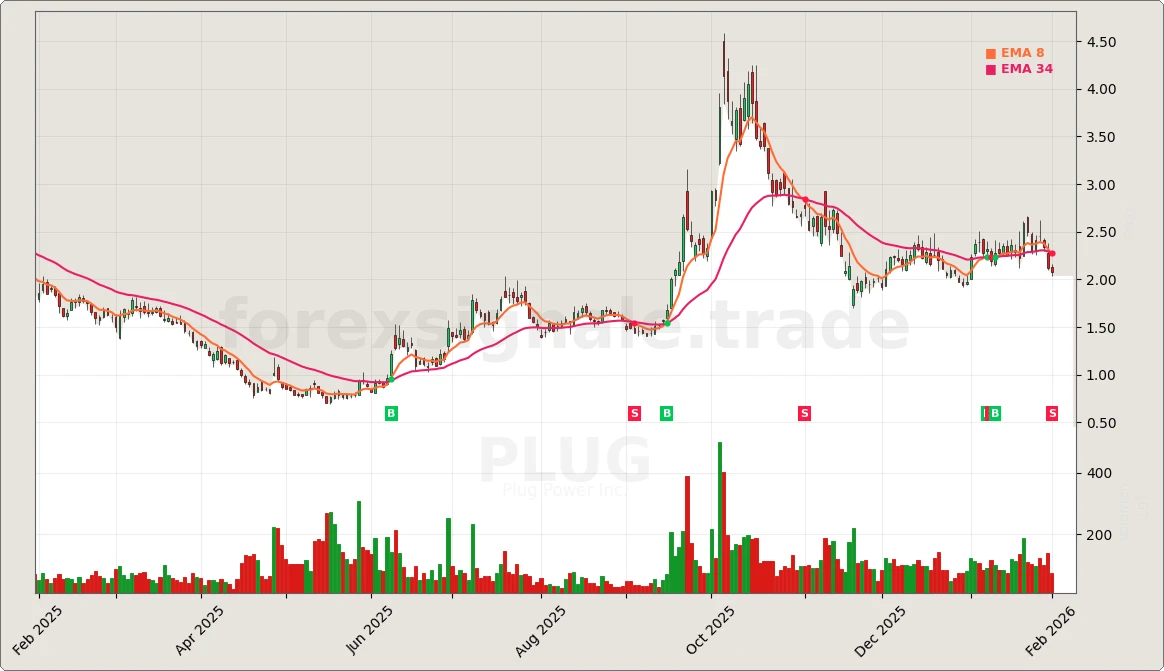

PLUG

Bearish

50%

Bearish

50%

WAC.DE

Bearish

50%

Bearish

50%

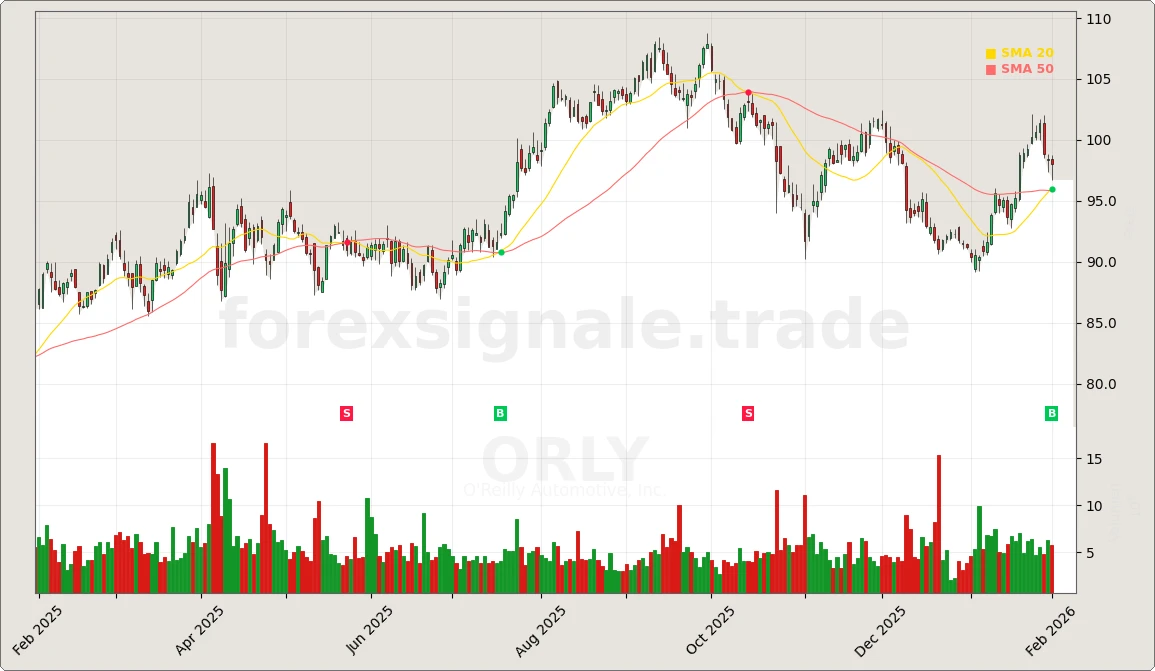

ORLY

Bullish

50%

Bullish

50%

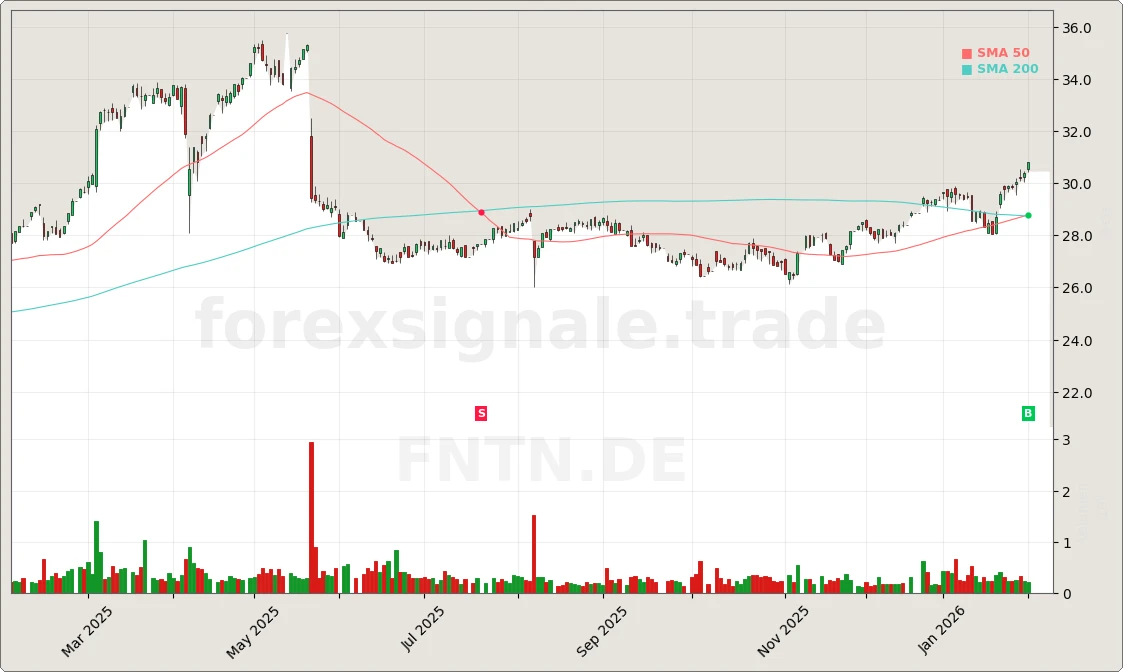

FNTN.DE

Bullish

50%

Bullish

50%

ICLR

Bearish

50%

Bearish

50%

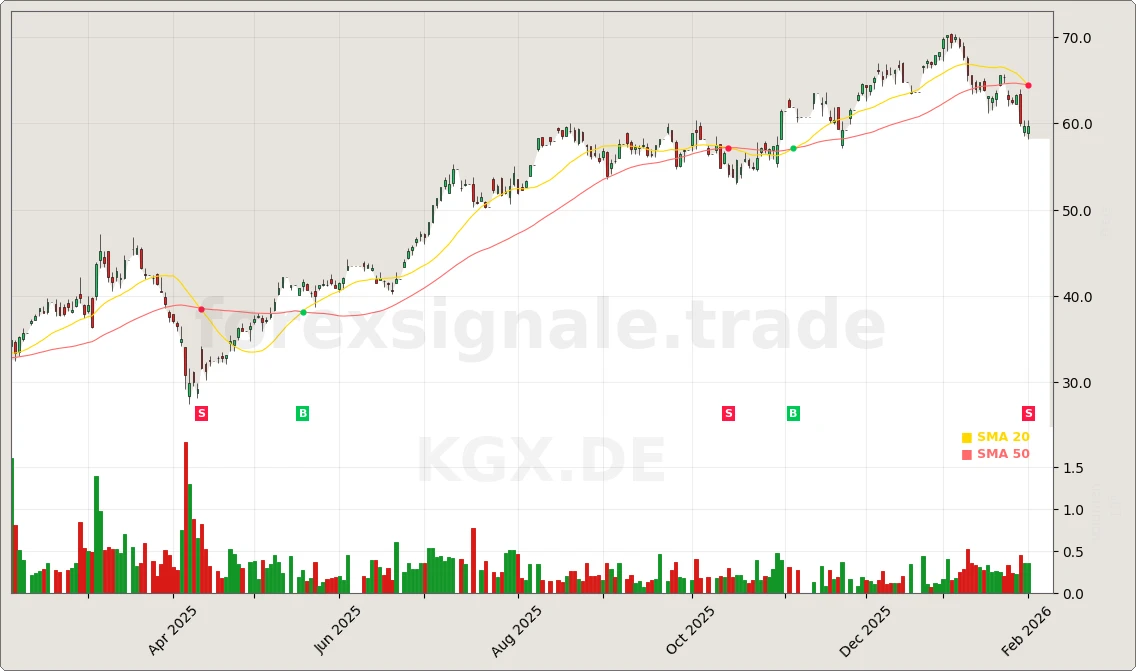

KGX.DE

Bearish

50%

Bearish

50%

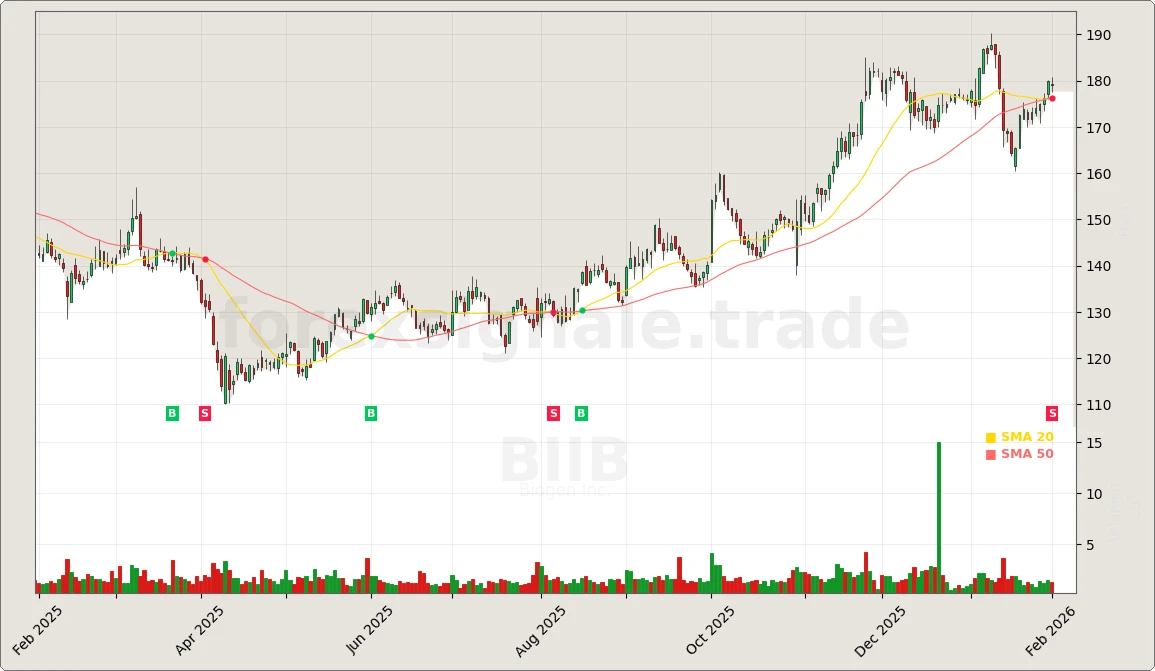

BIIB

Bearish

50%

Bearish

50%

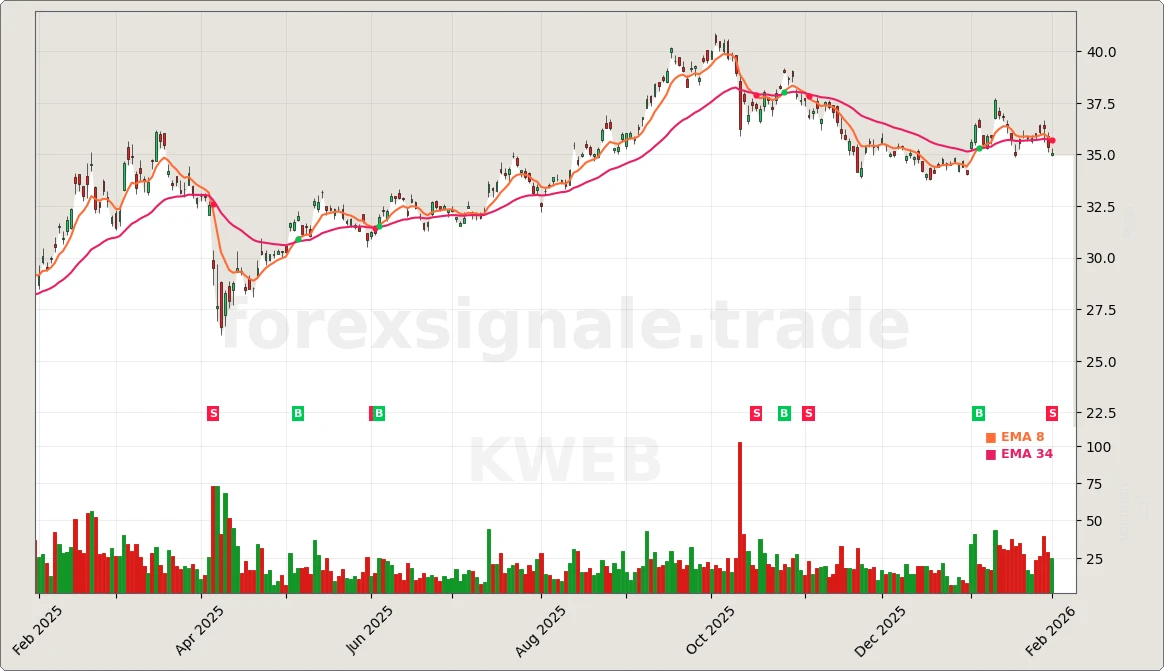

KWEB

Bearish

50%

Bearish

50%

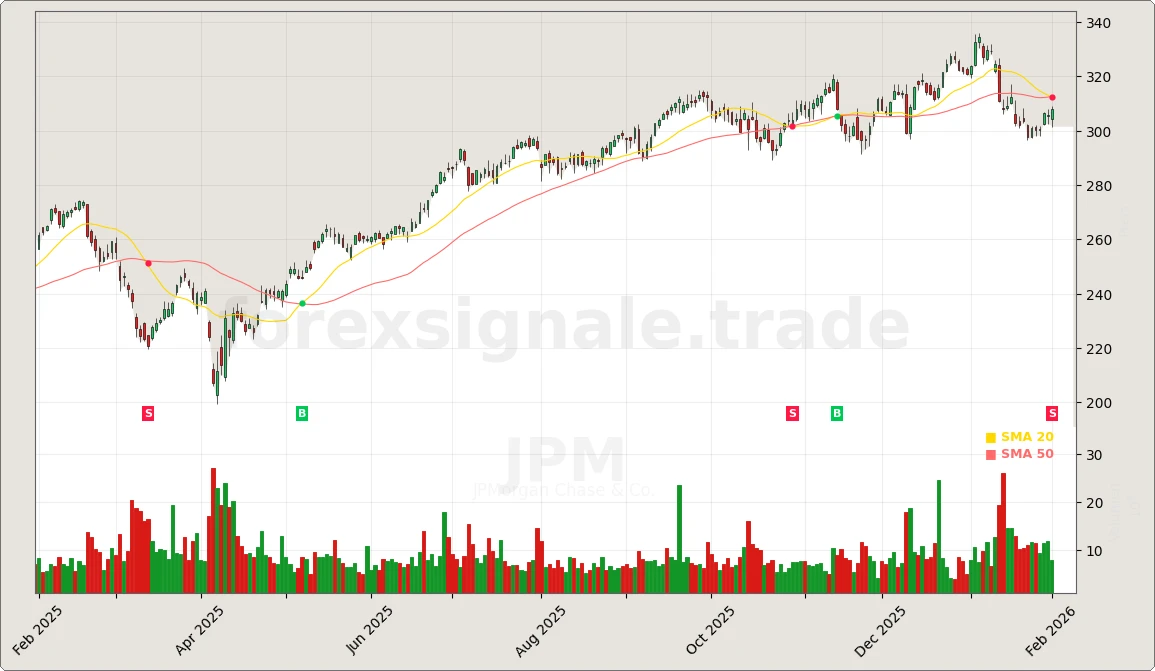

JPM

Bearish

50%

Bearish

50%

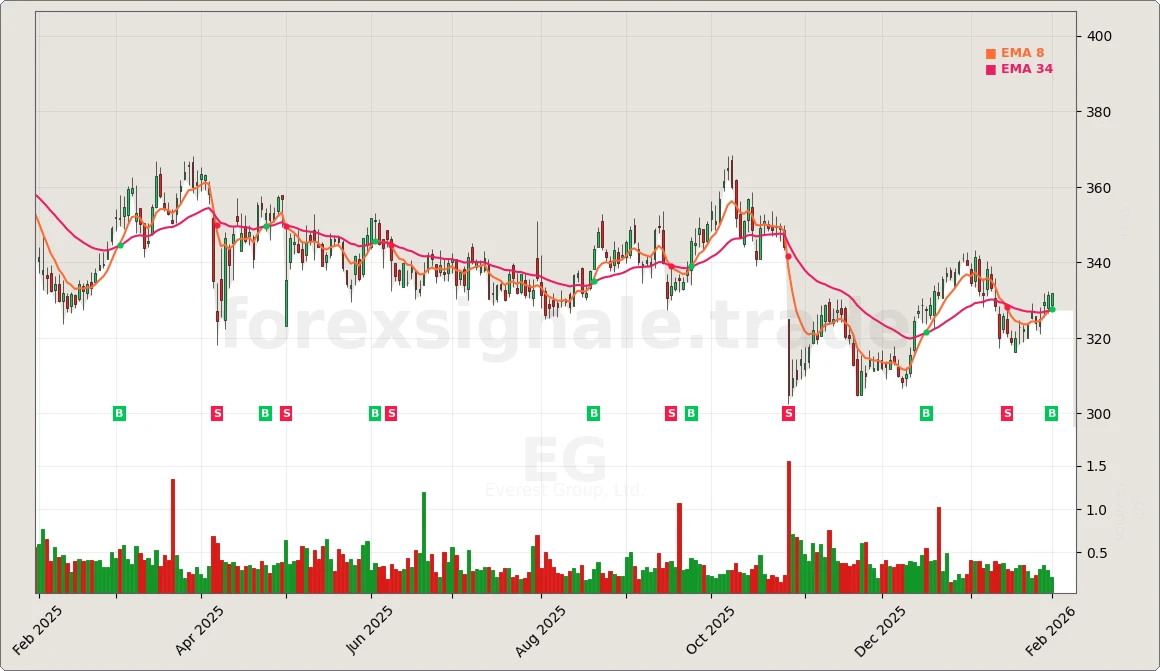

EG

Bullish

50%

Bullish

50%

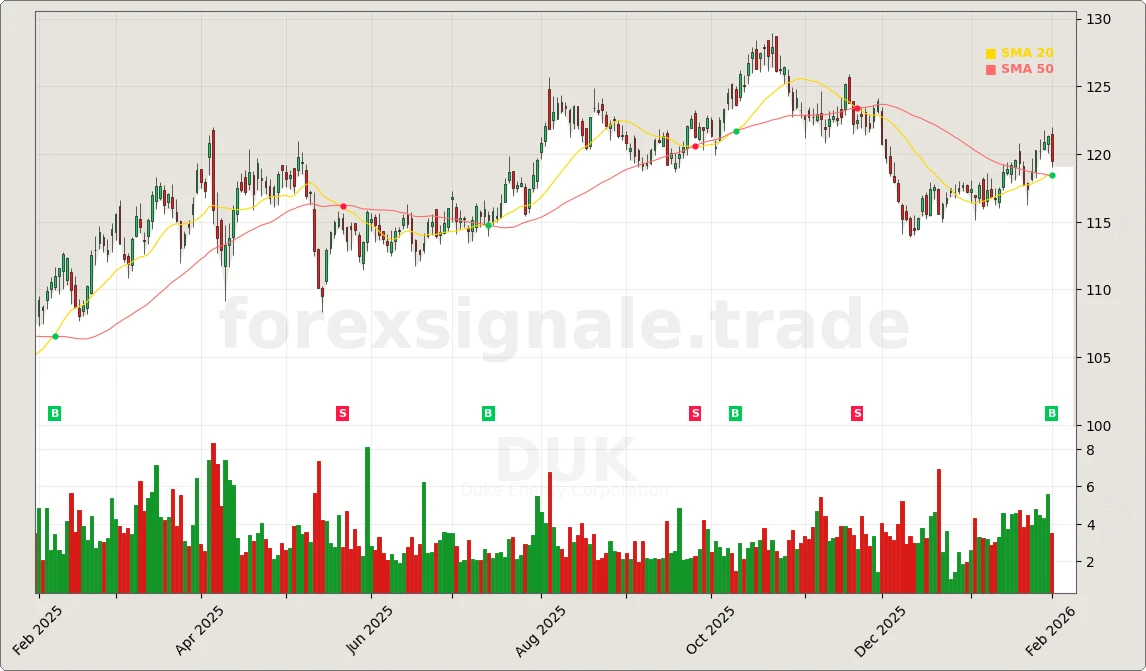

DUK

Bullish

50%

Bullish

50%

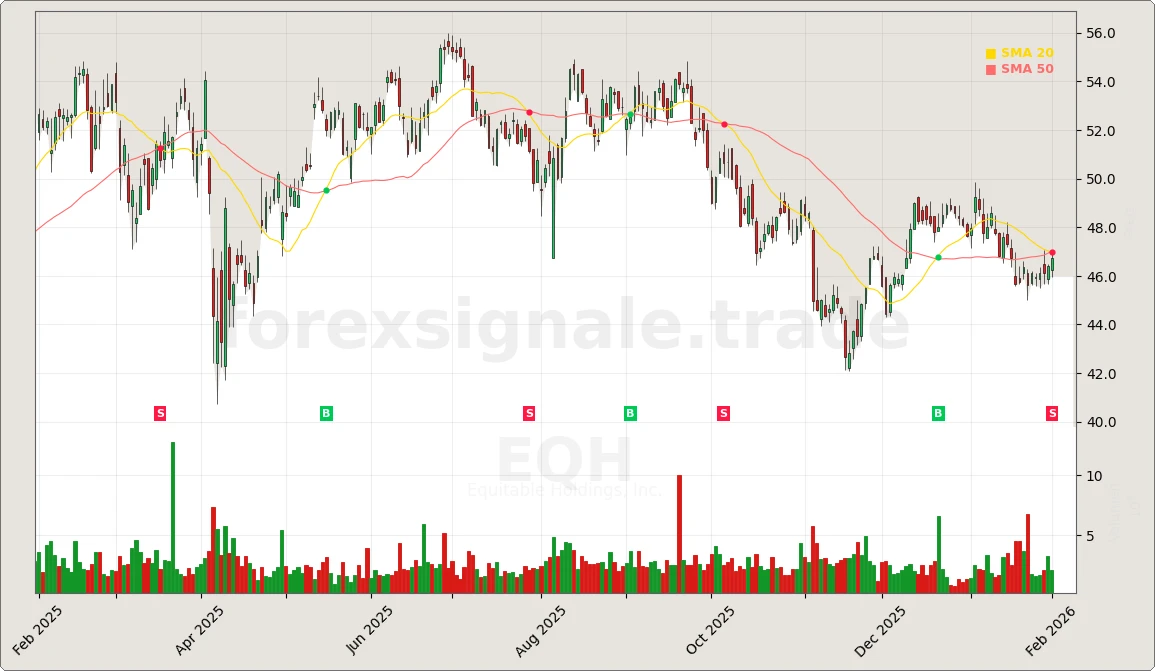

EQH

Bearish

50%

Bearish

50%

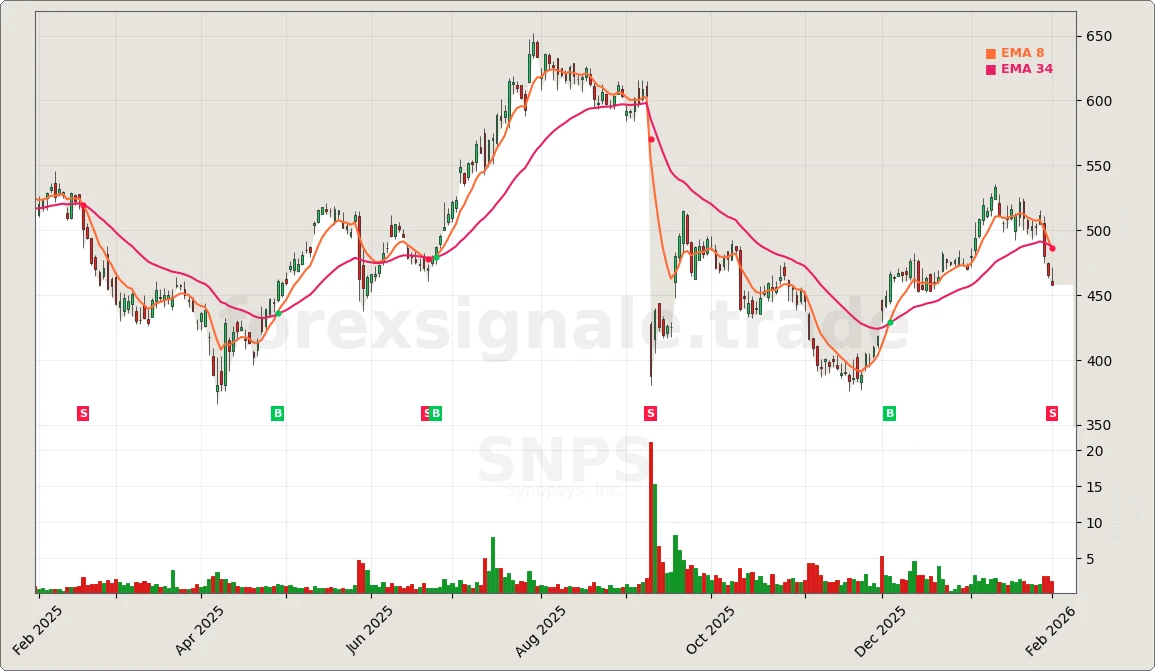

SNPS

Bearish

50%

Bearish

50%

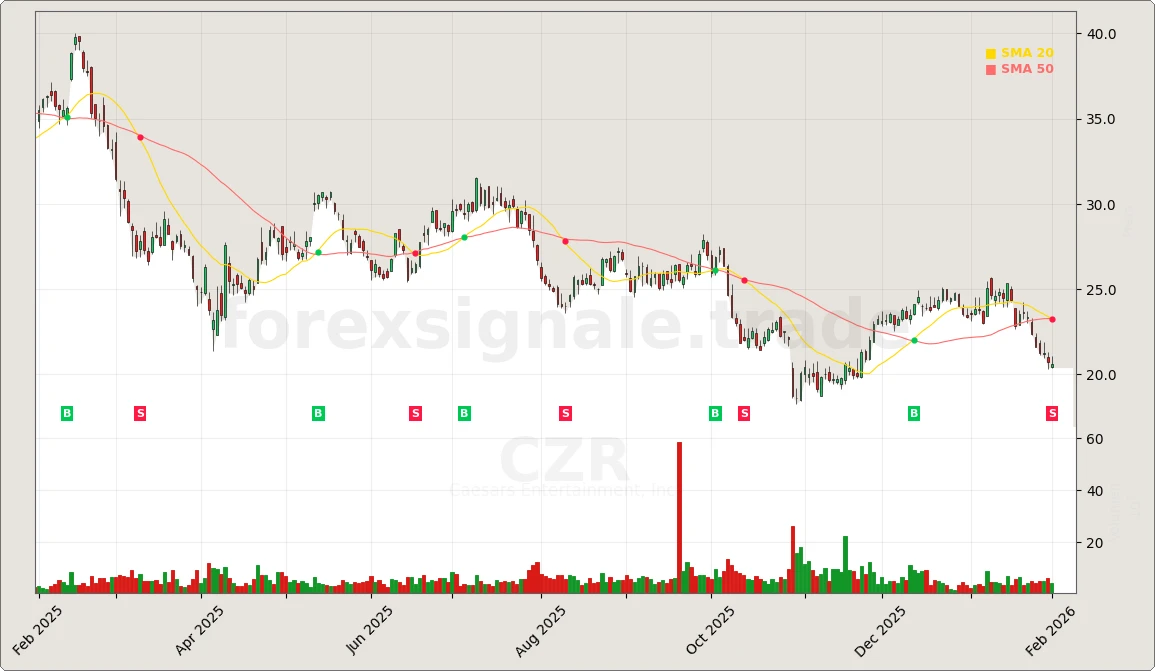

CZR

Bearish

50%

Bearish

50%

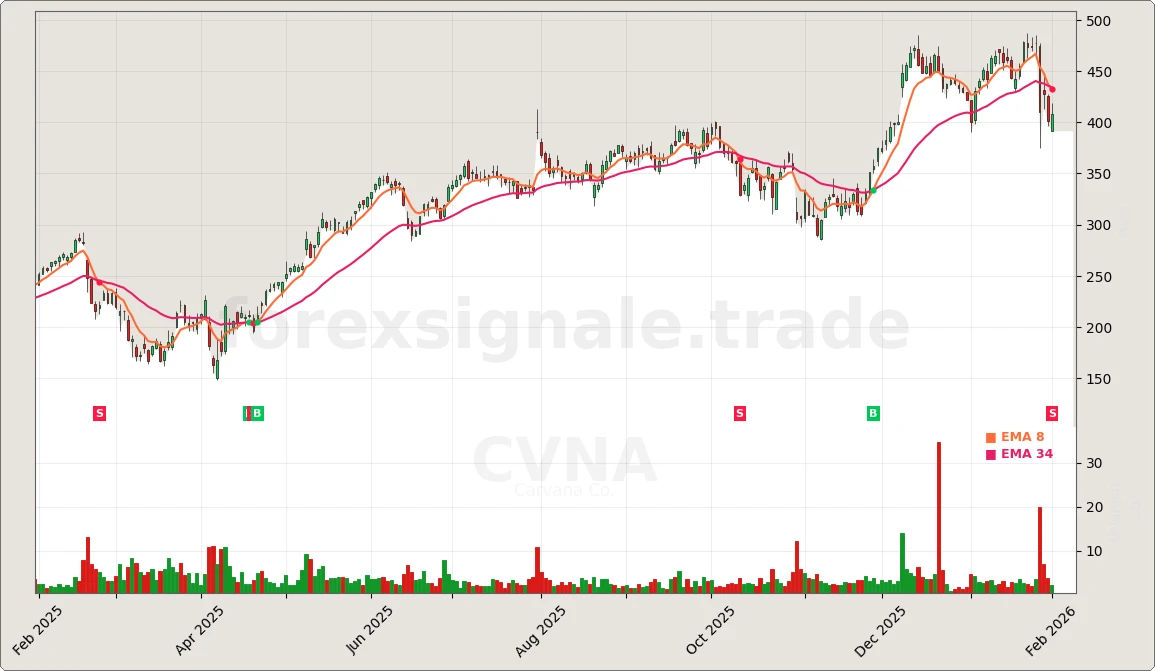

CVNA

Bearish

50%

Bearish

50%

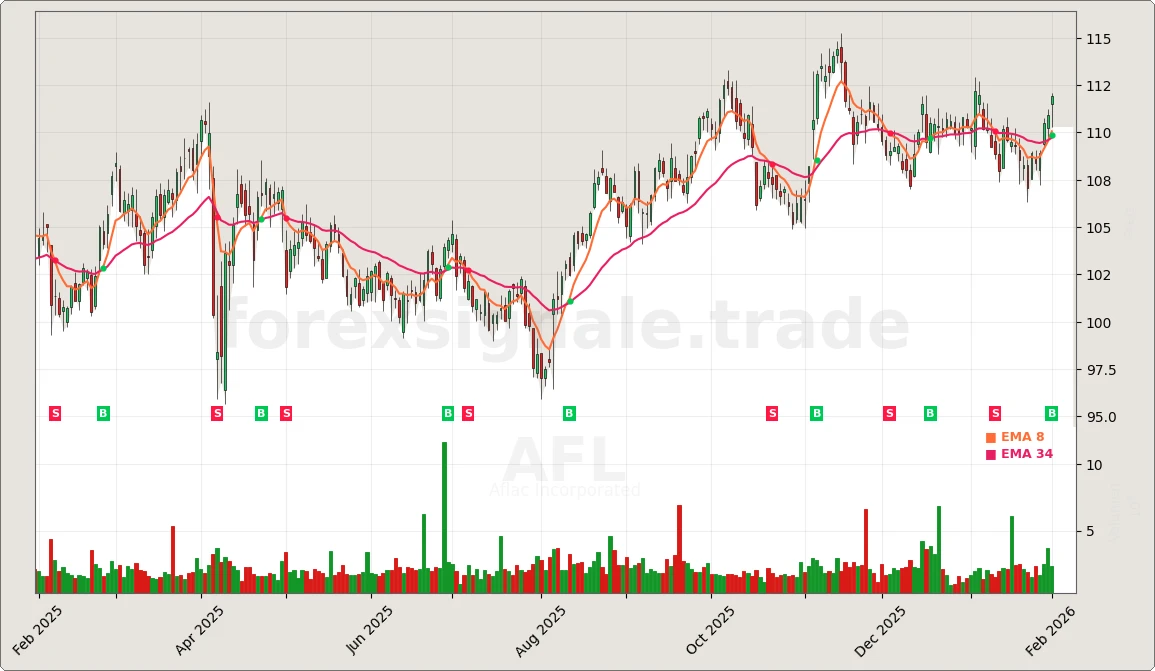

AFL

Bullish

50%

Bullish

50%

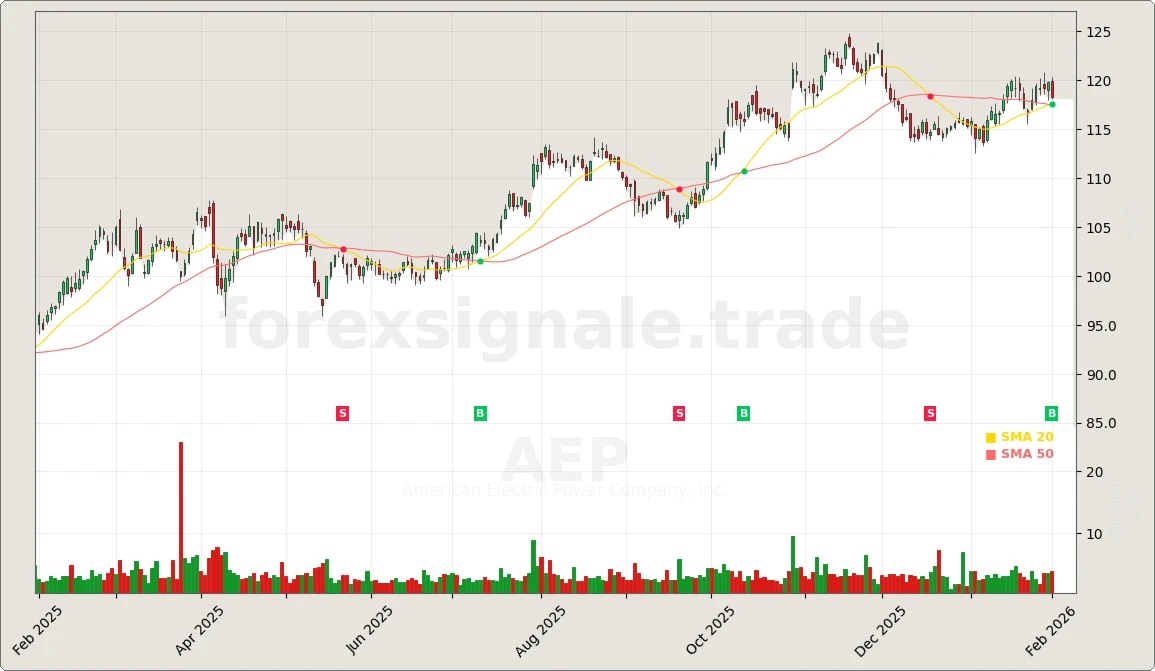

AEP

Bullish

50%

Bullish

50%

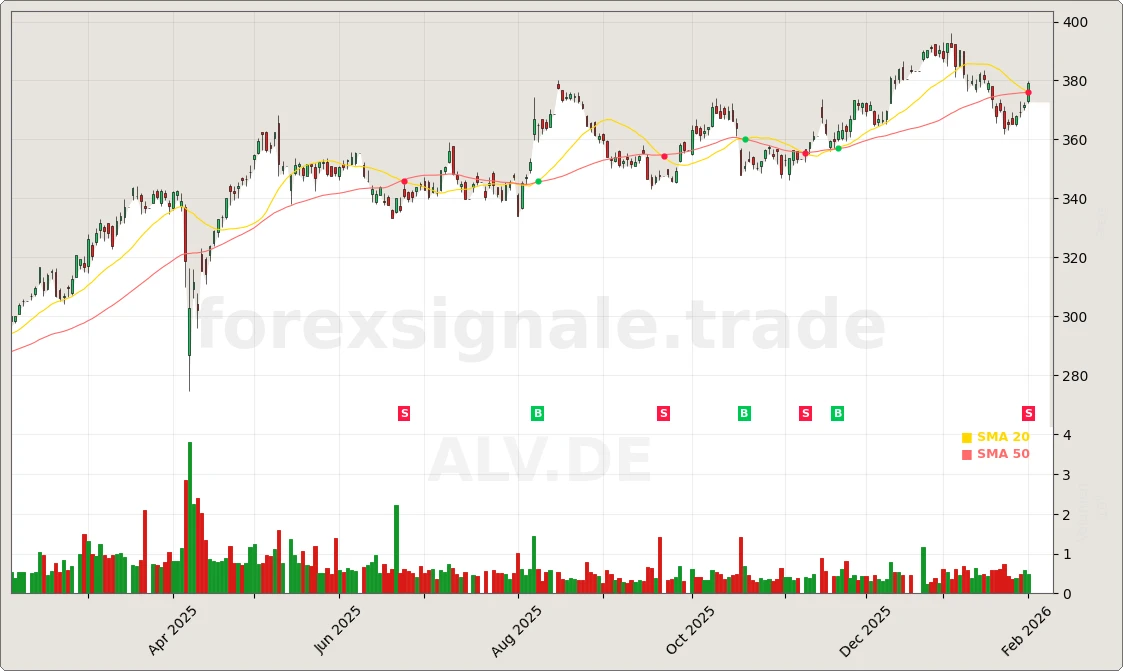

ALV.DE

Bearish

50%

Bearish

50%

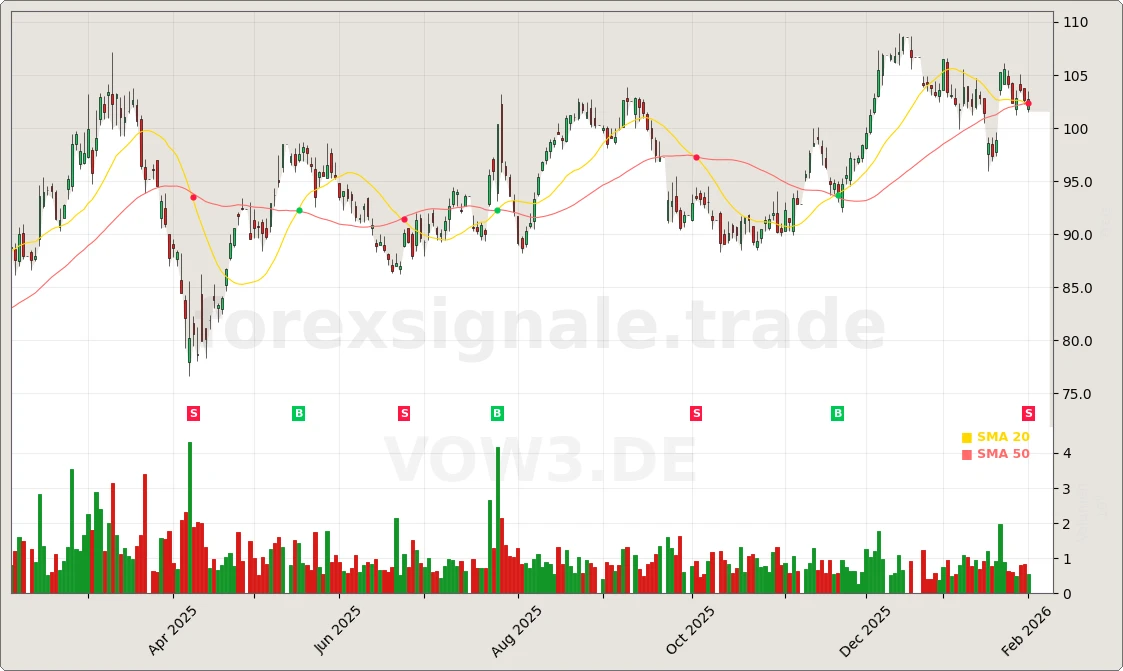

VOW3.DE

Bearish

50%

Bearish

50%

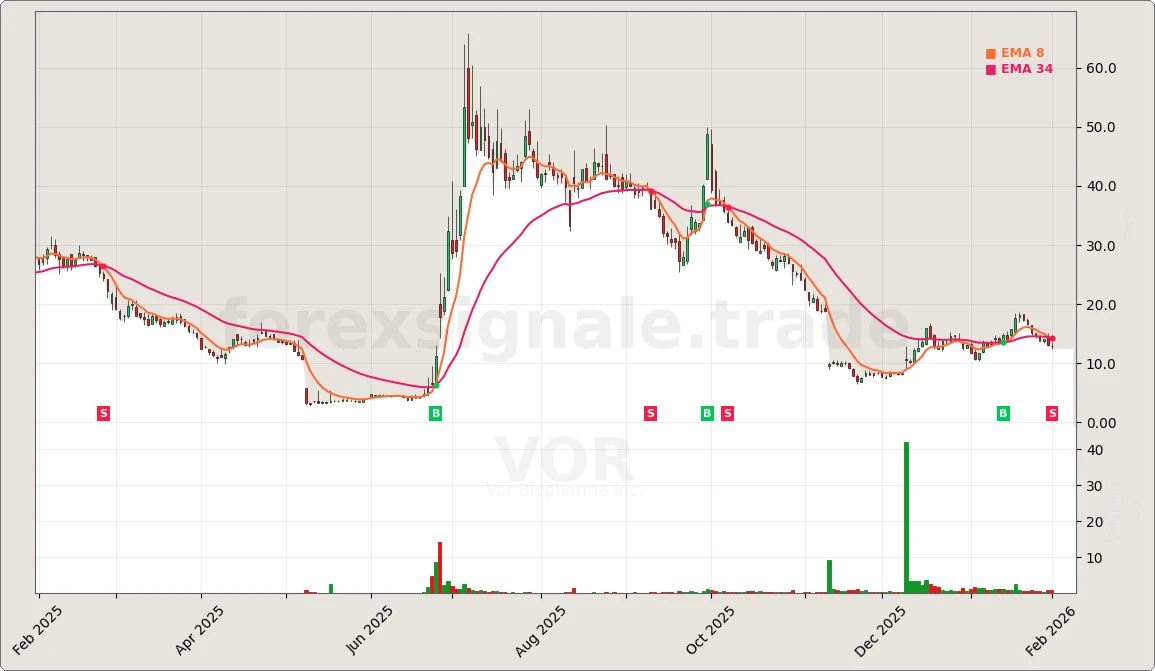

VOR

Bearish

50%

Bearish

50%

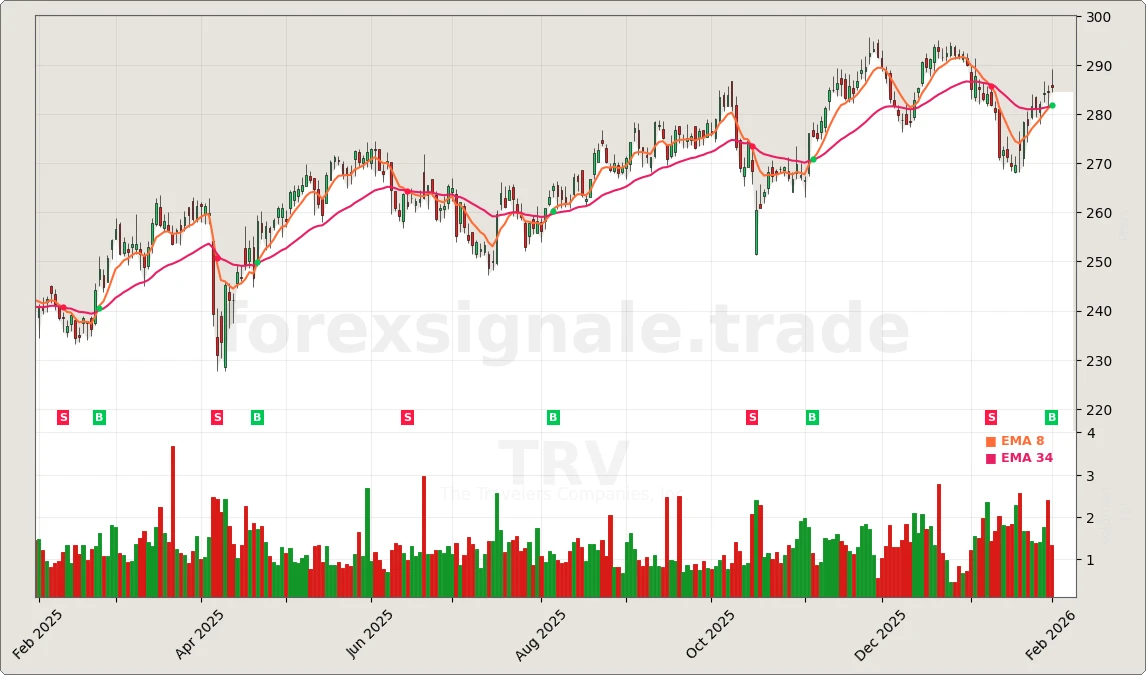

TRV

Bullish

50%

Bullish

50%

USB

Bullish

45%

Bullish

45%

IBE.MC

Bullish

45%

Bullish

45%

MTSI

Bullish

45%

Bullish

45%

CSX

Bullish

45%

Bullish

45%

QBTS

Bearish

45%

Bearish

45%

RMD

Bearish

45%

Bearish

45%

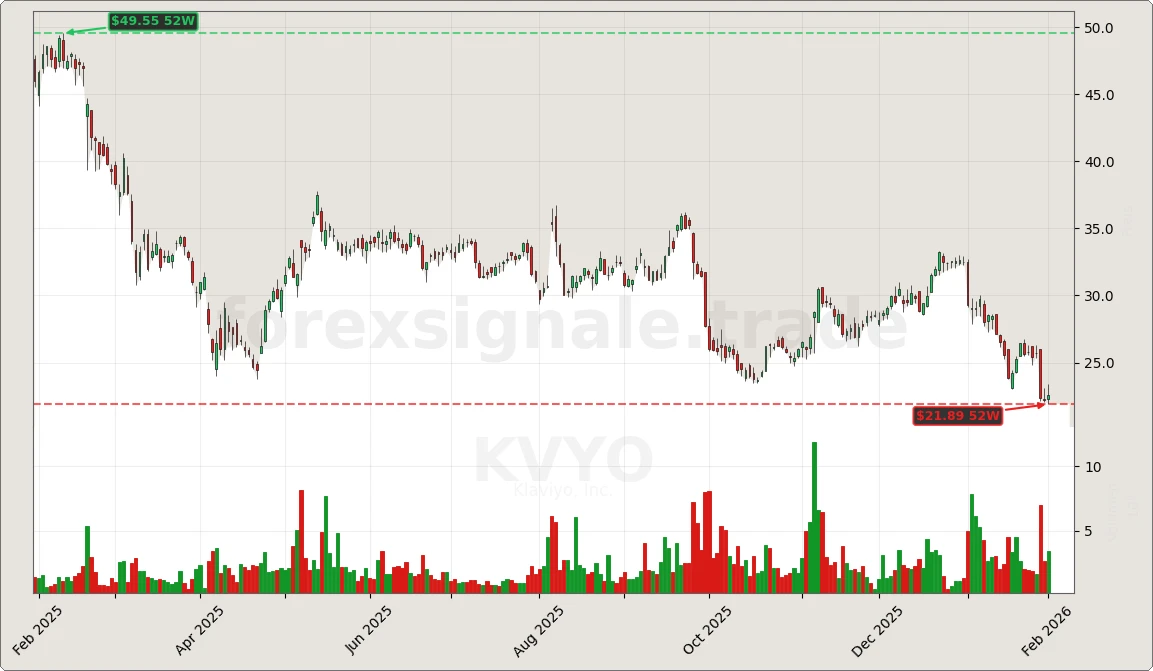

KVYO

Bearish

45%

Bearish

45%

UCG.MI

Bullish

45%

Bullish

45%

MSGE

Bullish

45%

Bullish

45%

RBGLY

Bullish

40%

Bullish

40%

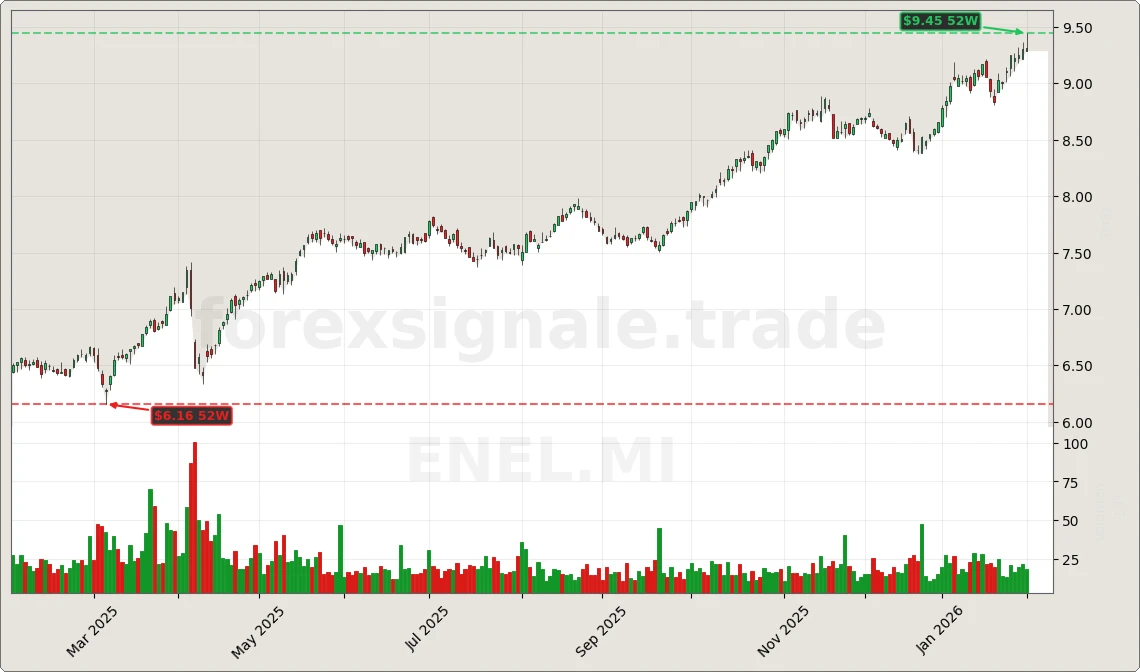

ENEL.MI

Bullish

35%

Bullish

35%

XLI

Bullish

35%

Bullish

35%

RNR

Bullish

35%

Bullish

35%

EXC

Bearish

35%

Bearish

35%

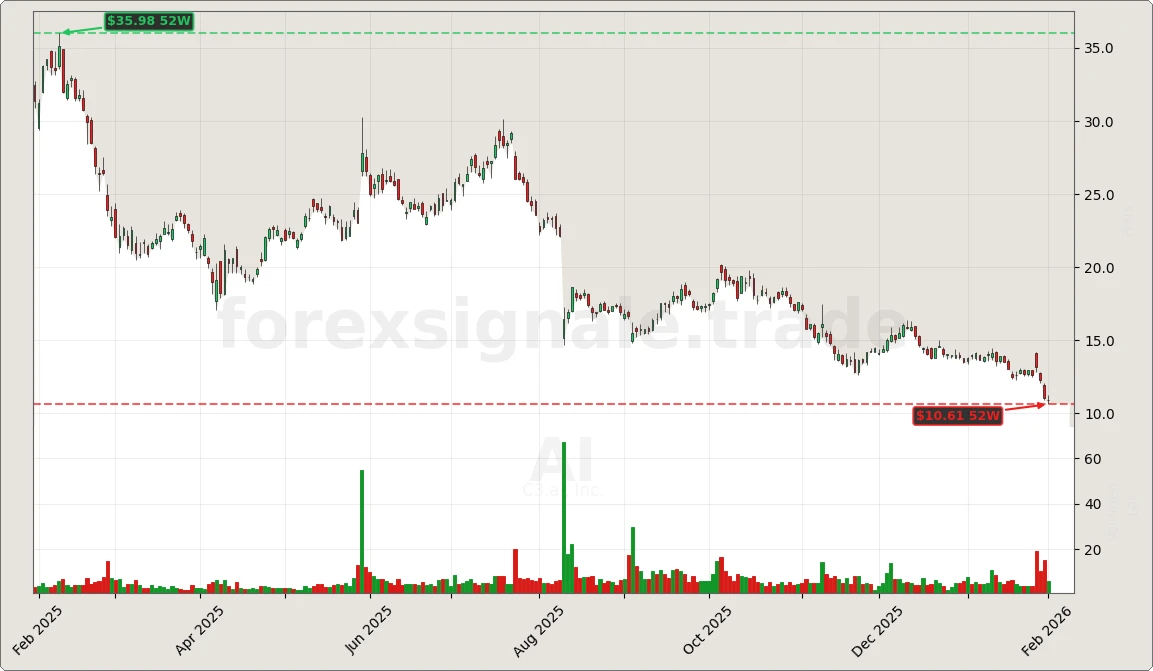

AI

Bearish

35%

Bearish

35%

NWBI

Bullish

35%

Bullish

35%

PNC

Bullish

35%

Bullish

35%

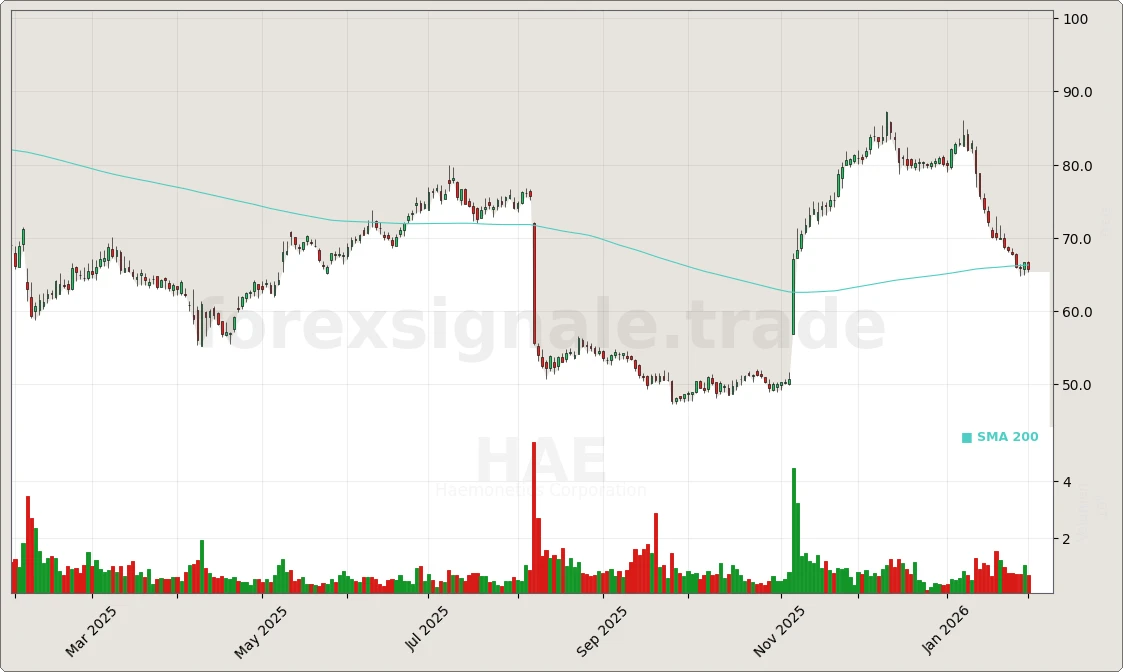

HAE

Bearish

35%

Bearish

35%

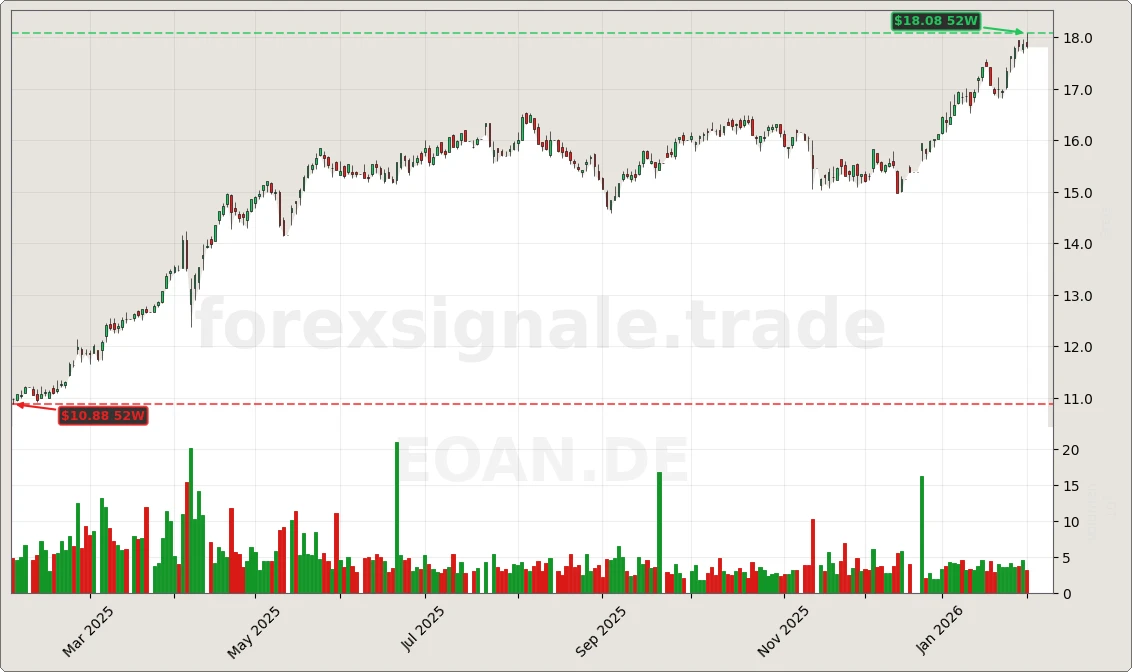

EOAN.DE

Bullish

35%

Bullish

35%

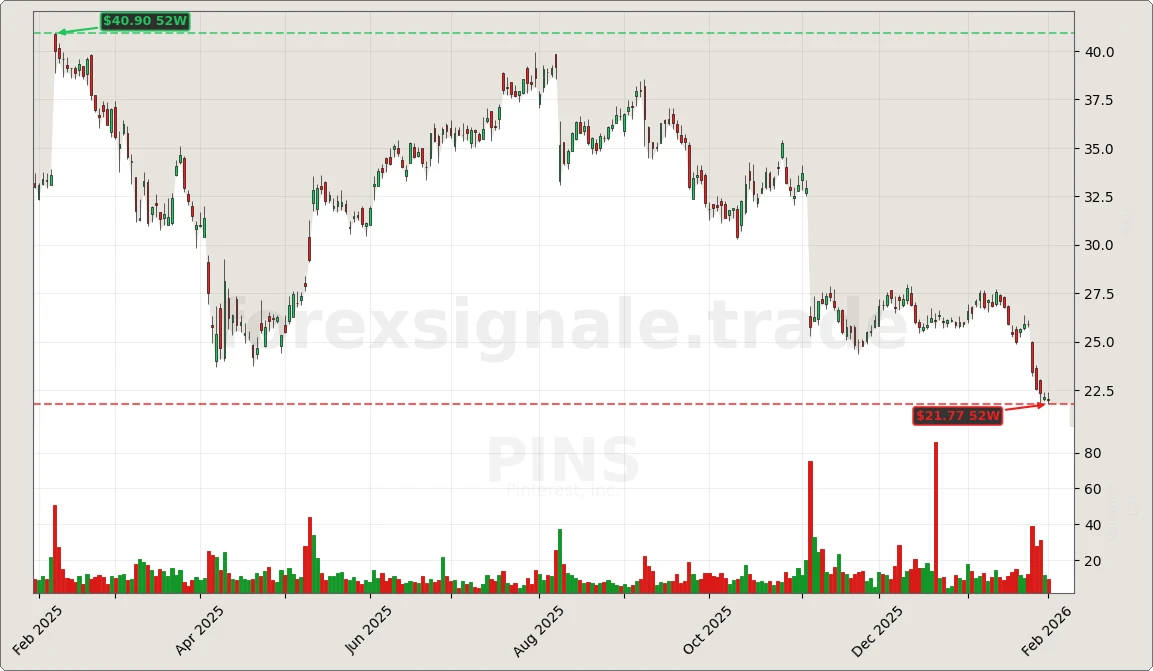

PINS

Bearish

35%

Bearish

35%

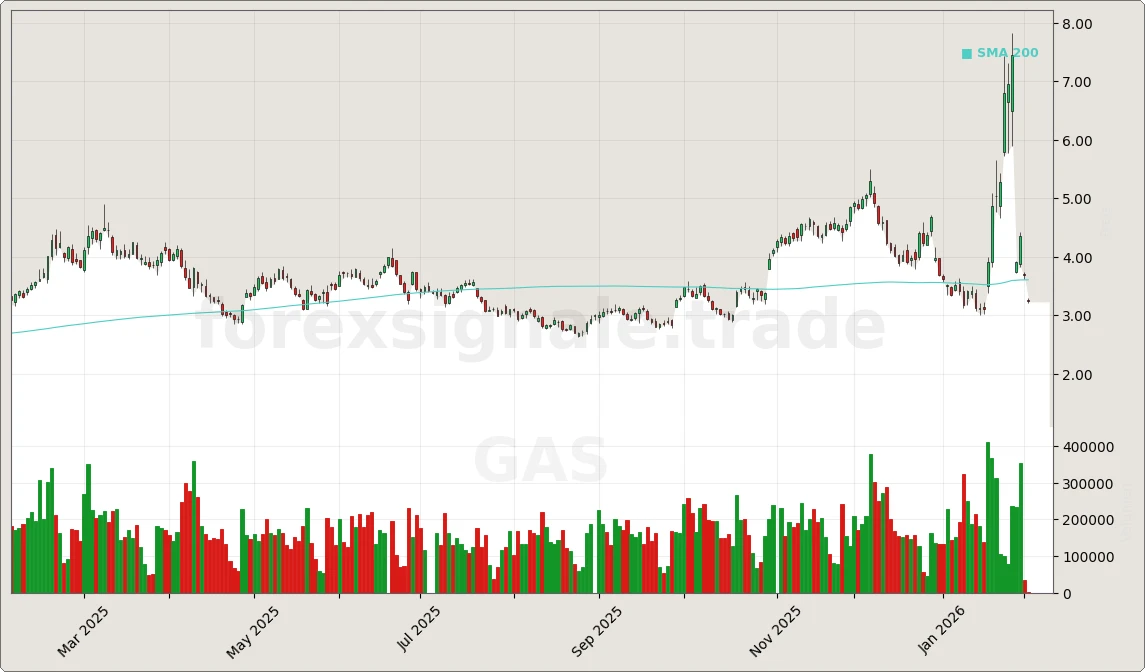

GAS

Bearish

35%

Bearish

35%

XLC

Bullish

35%

Bullish

35%

SPG

Bullish

35%

Bullish

35%

FCF

Bullish

35%

Bullish

35%

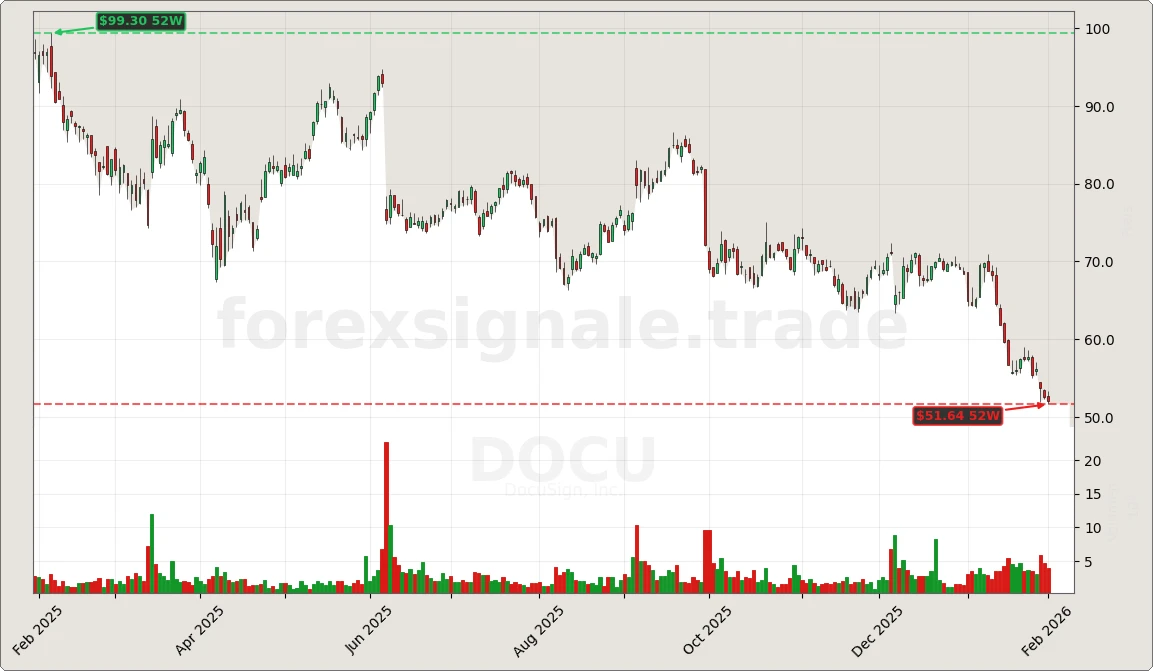

DOCU

Bearish

35%

Bearish

35%

EXSA

Bullish

35%

Bullish

35%

WTRG

Bearish

35%

Bearish

35%

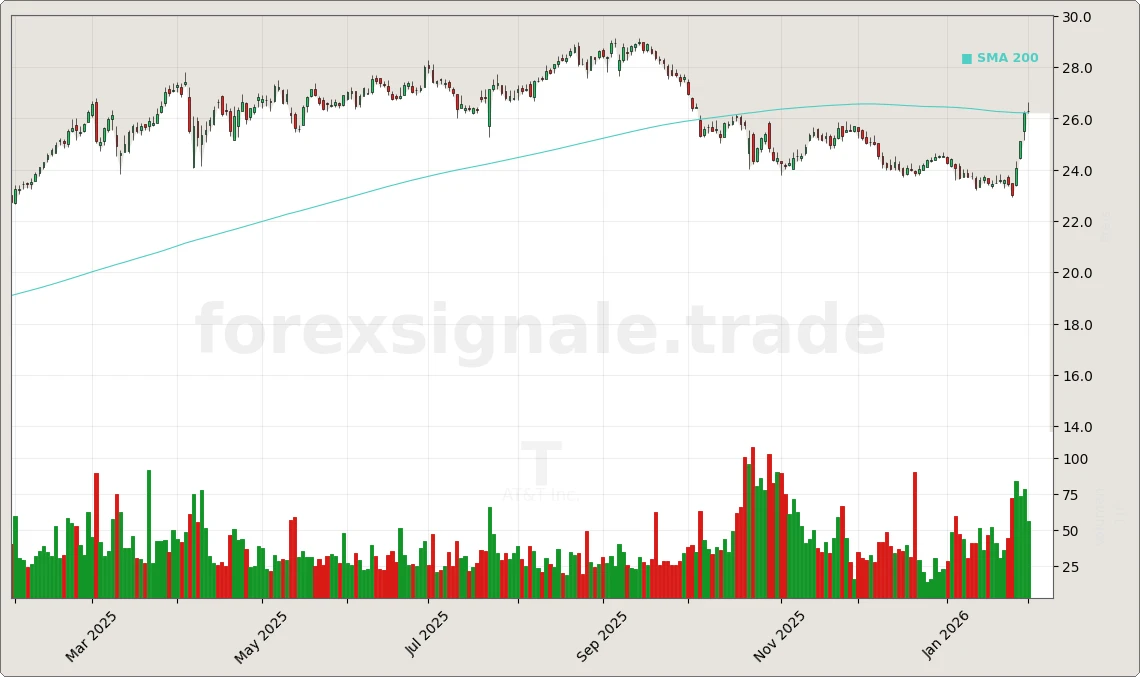

T

Bullish

35%

Bullish

35%

CME

Bullish

35%

Bullish

35%

PG

Bullish

35%

Bullish

35%

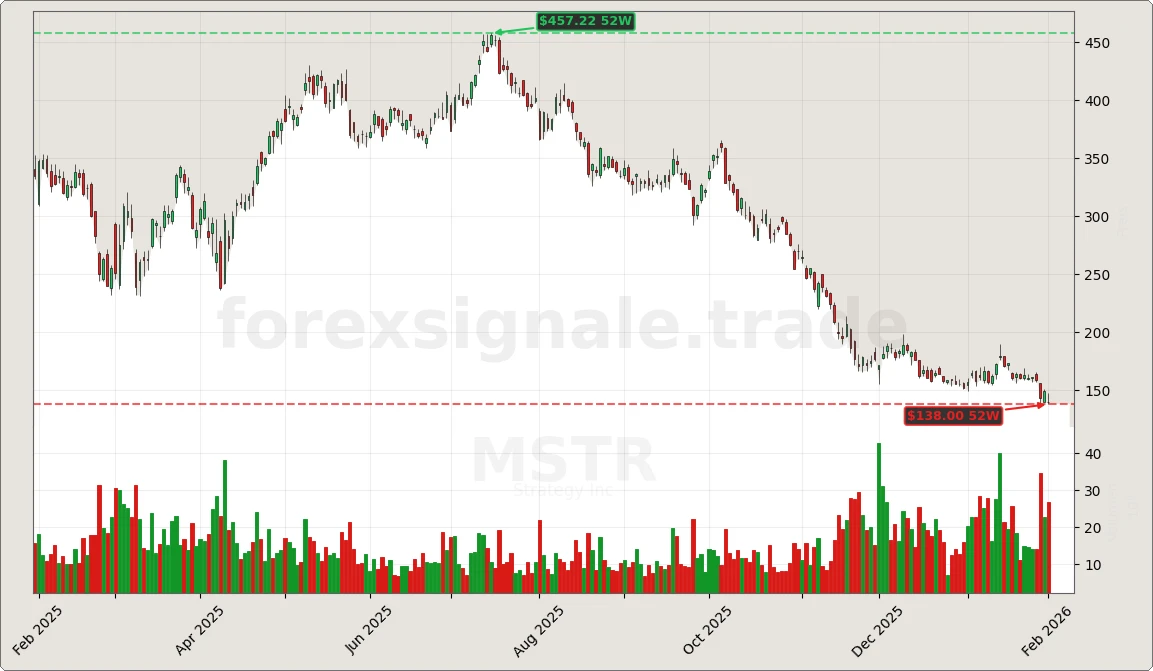

MSTR

Bearish

35%

Bearish

35%

SAZ

Bullish

30%

Bullish

30%

TLT

Bearish

20%

Bearish

20%

Disclaimer: Diese Signale dienen nur zu Informationszwecken und stellen keine Anlageberatung dar.